Navigating the Unlisted Shares Landscape in India

Investing in unlisted shares presents a unique opportunity to access the growth potential of emerging companies before they become publicly traded. However, this market has its own set of complexities. Understanding these nuances is essential for making sound investment choices. This includes knowing the key differences between listed and unlisted shares, and how to evaluate these often less transparent investment options. For a helpful guide, check out this resource: How to master the differences between listed and unlisted shares.

Understanding the Unlisted Market

Unlisted shares represent ownership in companies not traded on public exchanges like the NSE or BSE. Acquiring unlisted shares typically involves dealing directly with existing shareholders or through specialized brokers. A prime example of a successful unlisted company is the NSE itself.

The NSE boasts a substantial investor base, exceeding 100,000 investors as of 2025. Its unlisted share price has seen an increase from INR 3400 to INR 3700 per share. This strong demand, even without a public listing, stems from the NSE's robust financial performance. This includes a remarkable 47% increase in net profit, reaching Rs 12,187.94 crore for the financial year 2024-25. You can find more detailed statistics here. This case highlights the potential rewards of investing in promising unlisted companies.

Evaluating Investment Opportunities

The limited availability of public information on unlisted companies makes thorough due diligence even more critical. This involves a deep dive into the company's financial statements, a clear understanding of its business model, and a careful assessment of the management team's expertise.

Furthermore, understanding the company's competitive landscape and future growth trajectory is crucial. These factors are essential for determining the intrinsic value of an unlisted share. Thorough research helps mitigate the risks associated with limited transparency.

Navigating the Legal and Tax Implications

Understanding the legal and tax implications of investing in unlisted shares is paramount. This includes familiarity with regulations governing unlisted share transactions, such as SEBI guidelines and the tax implications related to holding periods. Selling Business Tax Implications offers additional insights into tax optimization strategies when selling shares.

Furthermore, a solid grasp of documentation requirements, transfer mechanisms, and potential tax benefits is important. By combining a thorough understanding of the investment landscape with awareness of the regulatory environment, investors can confidently navigate the unlisted share market.

The Upside and Downside: What You Need to Know

Investing in unlisted shares can be a profitable opportunity, but it's essential to understand both the potential rewards and the inherent risks. This balanced perspective will help you make informed decisions that align with your investment goals.

The Potential of Unlisted Shares

Unlisted shares offer the possibility of significant returns. By investing in companies before their Initial Public Offering (IPO), you can take advantage of early-stage growth and potentially higher valuations. This allows you to become a stakeholder in promising ventures before they achieve broader market recognition. Unlisted shares can also provide diversification for your investment portfolio, potentially reducing overall volatility. You might find this helpful: Our guide on the different types of unlisted shares.

Navigating the Challenges

However, the unlisted share market presents certain challenges. Liquidity is a primary concern. Selling unlisted shares can be more difficult than selling listed shares due to a less active market. This illiquidity can make it harder to quickly convert your investment into cash. Accurately valuing unlisted companies can also be tricky because of limited publicly available information. This lack of information can lead to uncertainty in pricing and the potential for over- or undervaluation.

The Indian Unlisted Shares Market: A Look at Resilience

The Indian unlisted shares market has shown resilience during market fluctuations. For instance, in early 2025, when Indian equity markets experienced a downturn influenced by foreign institutional investors, the unlisted equity space remained relatively stable. This stability can be attributed to the limited availability and lower trading volumes of unlisted shares, which tend to reduce price swings. This characteristic potentially makes unlisted shares a safe harbor during periods of market uncertainty. Financial services and NBFCs (Non-Banking Financial Companies) have drawn investor interest due to strong earnings and appealing valuations, with companies like Tata Capital and HDB Financial Services being popular choices. Learn more about unlisted market resilience.

Weighing the Risks and Rewards

Ultimately, the decision to invest in unlisted shares depends on your individual risk tolerance and investment timeframe. These investments are generally better suited for investors with a long-term outlook who are comfortable with potentially higher levels of risk. Thoroughly understanding how to assess and manage those risks is crucial.

Your Roadmap to Buying Unlisted Shares Successfully

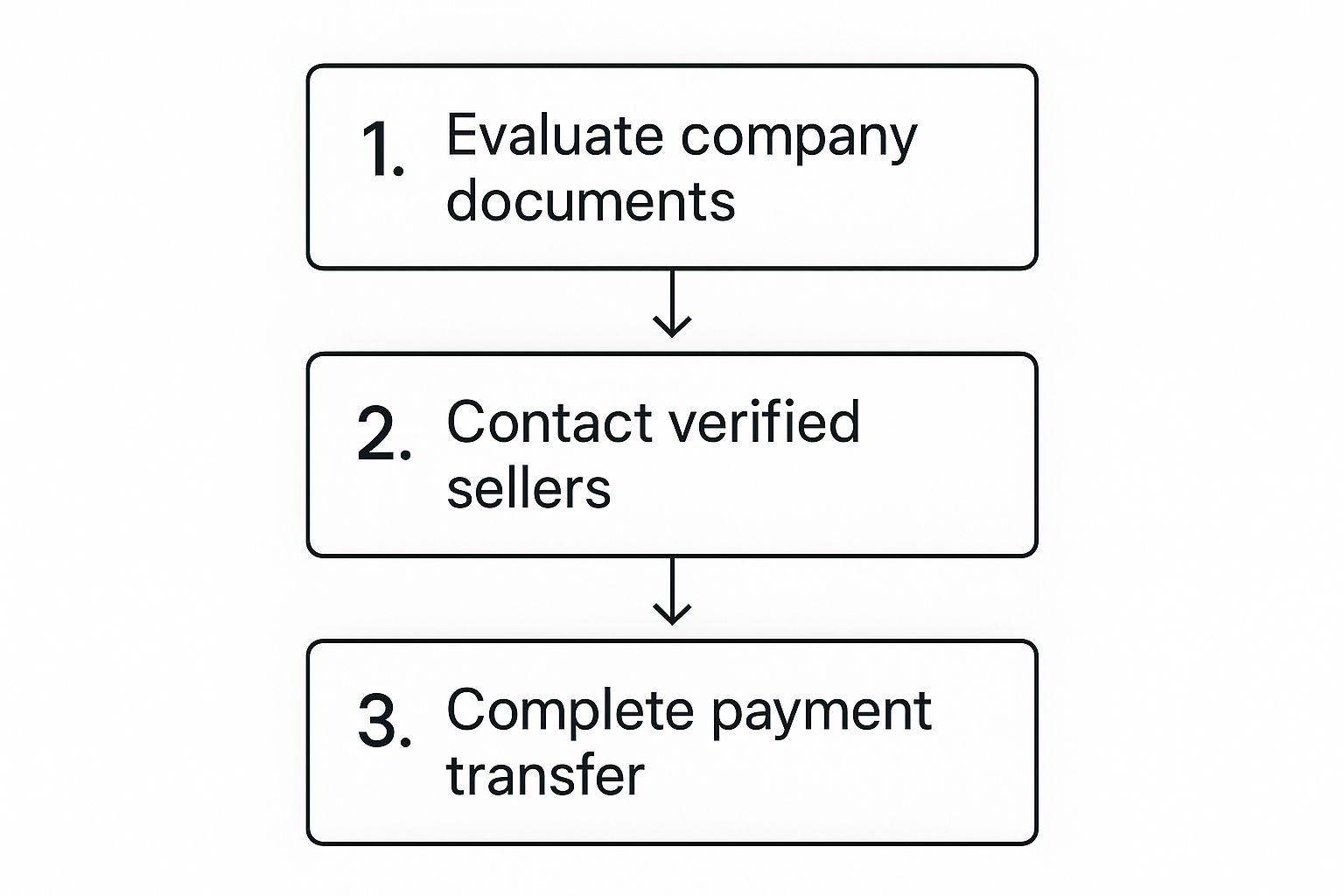

This infographic provides a visual guide to the process of acquiring unlisted shares. It highlights the key steps: evaluating company documents, connecting with verified sellers, and finalizing the payment. Each step is crucial and builds upon the previous one, offering a clear path for investors. Following these steps helps ensure a smooth and legally compliant transaction within the unlisted shares market.

Research and Identify Promising Companies

The first step is identifying companies with strong growth potential. This requires researching companies in sectors you understand and analyzing their financial performance. Look for consistent revenue growth, manageable debt levels, and a skilled and experienced management team.

Equally important is recognizing potential red flags. These could include frequent management changes or inconsistencies in financial reporting. Thorough initial research helps narrow down the investment universe and focus on the most promising opportunities.

Connecting With Intermediaries

After identifying potential investments, connecting with the right intermediaries is crucial. Specialized brokers, merchant banks, and online platforms like Unlisted Shares India facilitate these transactions.

When choosing an intermediary, consider their reputation, network of buyers and sellers, and the fees they charge. A reputable intermediary can streamline the transaction and minimize potential risks.

Navigating the Documentation Process

Buying unlisted shares requires specific documentation. You'll need to complete KYC (Know Your Customer) verification, link your Demat account, and provide banking information for fund transfers.

Preparing these documents in advance streamlines the purchase process and allows you to act quickly when opportunities arise.

Understanding Price Discovery and Negotiation

Unlike listed shares, unlisted shares don't have a publicly displayed price. Price discovery involves negotiating with the seller. Researching comparable transactions can help determine a fair price range.

Be prepared to negotiate and walk away if the price isn't suitable. This approach is essential in a market with less price transparency.

Legal and Tax Considerations

Understanding the legal and tax implications of unlisted share transactions is vital. Familiarize yourself with SEBI guidelines governing these transactions.

Also, consider the tax implications based on your holding period. Long-term capital gains on unlisted shares held for over two years are generally taxed at a lower rate than short-term gains. Consulting a tax advisor can provide clarity and ensure compliance.

Before proceeding with an unlisted share purchase, it's essential to gather the correct documentation. The following table outlines the essential documents Indian investors need.

| Document Type | Purpose | Issuing Authority | Validity Period |

| PAN Card | Identity verification | Income Tax Department | Permanent |

| Aadhaar Card | Address and identity proof | UIDAI | Permanent |

| KYC Documents | Compliance with regulatory requirements | Intermediary (Broker/Platform) | As per intermediary guidelines |

| Demat Account Details | Holding shares electronically | Depository Participant (DP) | Ongoing until account closure |

| Bank Account Details | Facilitating fund transfers | Respective Bank | Ongoing until account closure |