Unlisted Shares: Your Gateway to India's Private Markets

Before diving into selling unlisted shares, it's important to understand what makes these investments unique. Unlisted shares represent ownership in companies not publicly traded on exchanges like the NSE or BSE. This means different rules apply compared to public stocks, creating both opportunities and challenges. For a deeper dive into the fundamentals, check out this helpful resource: How to master....

These shares reside within India's private markets, often attracting investors seeking potentially higher returns. However, this potential comes with reduced liquidity. It can be more difficult to buy or sell these shares compared to those readily available on public exchanges. This liquidity difference significantly impacts valuation and timing when selling.

Understanding the Dynamics of Unlisted Shares

Valuation in the unlisted market differs greatly from the public market. Publicly traded companies have readily available market prices, constantly influenced by trading activity. Unlisted shares, however, require more analysis to determine value.

Factors influencing valuation include future growth potential, company financials, and current market sentiment. These elements play crucial roles in assessing the true worth of unlisted shares.

Timing is also critical when selling unlisted shares. Due to lower liquidity, finding the right buyer at the desired price requires patience and a strategic approach. This contrasts sharply with public markets where transactions happen almost instantly.

Understanding market conditions is paramount when selling unlisted shares in India. For example, in early 2025, despite a downturn in the broader Indian equity markets due to factors like high valuations and global trade tensions, the unlisted equity space demonstrated relative stability. This stability is largely due to the limited liquidity and lower trading volumes, which act as buffers against volatility.

Sectors like financial services and non-banking financial companies (NBFCs) attracted investor interest due to strong earnings growth and positive fundamental indicators. This presents potential long-term growth opportunities within the unlisted market. However, challenges such as limited liquidity and regulatory complexities still exist. For further insights, explore this article: the stability of the unlisted market.

Knowing your target audience is key. High-net-worth individuals, family offices, and venture capital firms are often interested in unlisted shares. They are typically comfortable with the lower liquidity and longer investment timelines associated with private markets. Understanding their preferences is crucial for a successful sale. By considering these factors, navigating the unlisted share market becomes more manageable, increasing your chances of a successful sale.

The Step-by-Step Roadmap to Selling Your Unlisted Shares

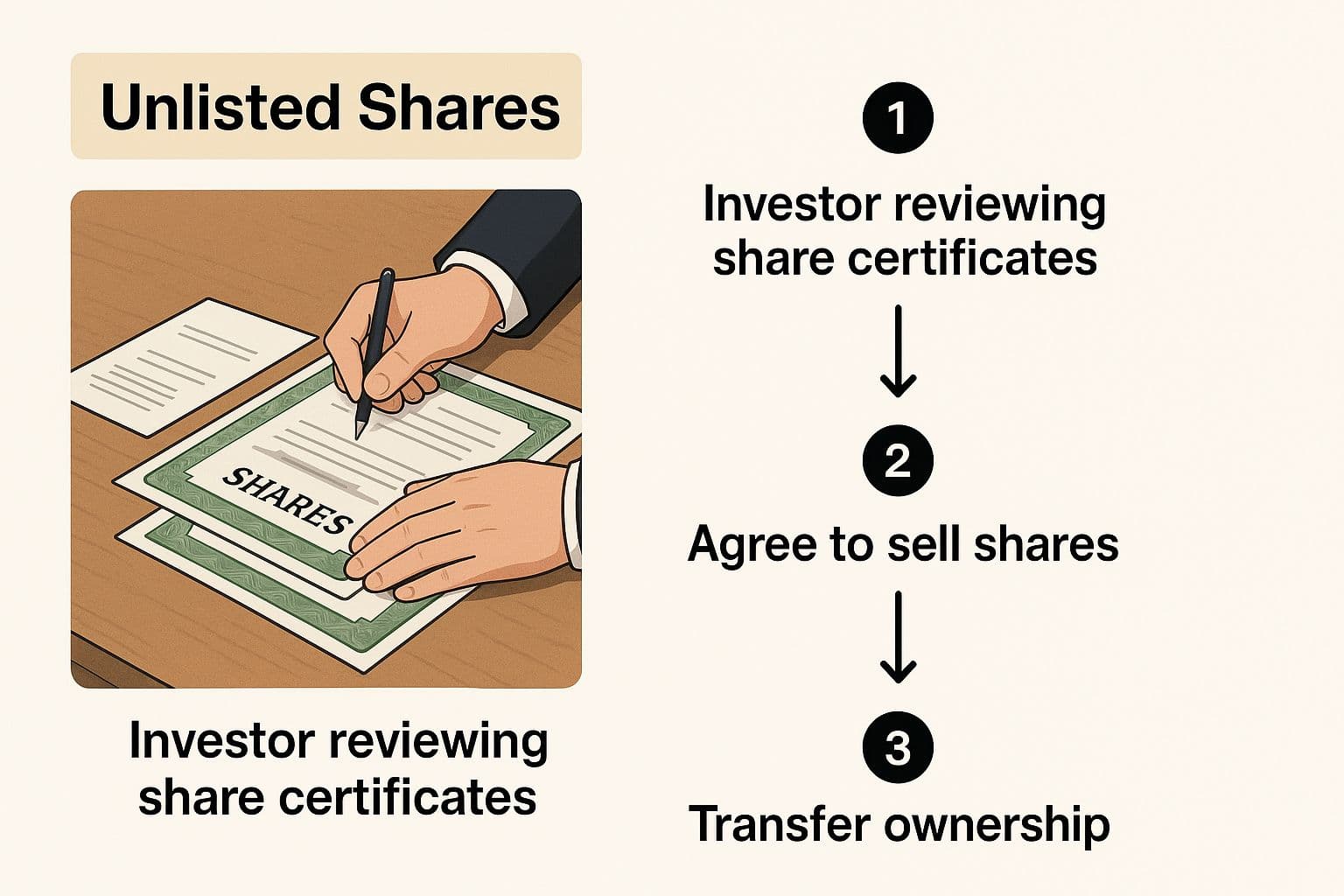

The infographic above depicts an investor reviewing physical share certificates. This visual reminds us that unlisted shares represent tangible ownership and underscores the importance of proper documentation throughout the selling process. Careful review and organization of these documents are essential.

Selling unlisted shares can feel complex, but it becomes much more manageable when broken down into clear, actionable steps. This roadmap will guide you through each stage of the process, from initial preparation to final settlement, helping ensure a smooth and successful experience within India's private markets.

Preparing For the Sale

First, gather all the necessary documents related to your shares. These typically include share certificates, transfer deeds, and any agreements pertaining to their initial acquisition. It's also important to verify the current status of your shares. This confirms their validity and identifies any potential restrictions on their sale. This thorough preparation forms the foundation for a successful transaction.

Finding The Right Buyer

Next, you'll need to identify potential buyers within India's specialized unlisted shares market. You can connect with interested parties through various channels, including specialized brokers, online platforms like Unlisted Shares India, and direct networking within high-net-worth investor circles. Thorough due diligence is critical to ensure the legitimacy of any potential buyer. Researching their investment history and verifying their financial standing can help mitigate potential risks.

The sale of unlisted shares in India involves several key steps: finding a buyer, agreeing on a price reflecting market dynamics, and ensuring full regulatory compliance. For example, the price of NSE India Limited unlisted shares has recently risen from INR 3400 to INR 3700 per share, illustrating the impact of market demand and company performance. Regulatory bodies closely oversee share transfers, using mechanisms like periodic suspension and activation of the International Securities Identification Number (ISIN). Despite these complexities, unlisted shares can offer attractive returns for discerning long-term investors. Learn more about NSE India Limited unlisted shares.

Negotiating And Executing The Sale

Once you've identified a prospective buyer, the next step is negotiating a mutually agreeable price. Transparency about the company's performance and financial data is essential. Open communication builds trust and strengthens your negotiating position, facilitating a smoother transaction.

Settlement And Transfer

After reaching an agreement, the final stage involves the formal transfer of shares. This requires completing the necessary paperwork, paying applicable stamp duty, and adhering to all regulatory requirements mandated by SEBI and company law. Accuracy in documentation is paramount to avoid delays or complications. Proactively addressing potential issues, such as right-of-first-refusal clauses within shareholder agreements, ensures a seamless transfer. By following these steps, you can streamline the sale of your unlisted shares and maximize the likelihood of a successful and efficient transaction.

Finding Serious Buyers in a Niche Marketplace

Connecting with the right buyers for your unlisted shares is crucial. This section explores the networks where these securities are traded, from specialized brokers to online platforms and high-net-worth individual circles. You'll learn how to position your offerings, identify potential problems, and negotiate effectively.

Navigating the Unlisted Share Networks

The market for unlisted shares operates differently than public exchanges. It relies heavily on relationships and specialized knowledge. Specialized brokers play a key role, connecting buyers and sellers with their extensive networks. Digital platforms like Unlisted Shares India offer another avenue, providing a more transparent and accessible marketplace. Finally, high-net-worth investor circles present opportunities, though access can be challenging.

Positioning Your Offering for Success

Successfully selling unlisted shares involves presenting a compelling case to potential buyers. Clearly communicating the company's performance data is essential. This includes sharing financial statements, growth projections, and any relevant market analysis. Creating a value proposition that justifies your asking price is equally important. This involves highlighting the company's strengths, competitive advantages, and future potential.

Identifying and Avoiding Problematic Buyers

Not all buyers are created equal. Some may be speculative or lack the financial resources to complete the transaction. Look out for red flags such as unrealistic price expectations, requests for unusual payment terms, or evasiveness about their investment background. Performing investor due diligence is vital.

Before setting a price, thorough due diligence is essential. Learn more about what to look for in your target buyer with this article on investor due diligence. This protects your interests and ensures a smooth transaction.

Effective Negotiation Techniques

Negotiation is key to maximizing your returns. Be prepared to justify your asking price while also understanding the buyer's perspective. Flexibility and a willingness to compromise can lead to a mutually beneficial outcome.

Having a clear understanding of your bottom line and walking away from unfavorable deals is also crucial. Developing credibility is paramount in this market. Transparency, professionalism, and a strong understanding of the company and its prospects build trust with potential buyers.

Networking Within Specific Industry Sectors

Targeting buyers within relevant industry sectors can increase your chances of success. For example, if you are selling shares in a technology company, networking with venture capitalists or angel investors specializing in tech startups would be beneficial. Industry-specific events, online forums, and professional networks can provide valuable connections.

Consider partnering with advisors specializing in unlisted share transactions. Their expertise and networks can prove invaluable, streamlining the process and maximizing your returns.

To help you navigate the complexities of this market, we've compiled a comparison of some popular platforms for trading unlisted shares.

The following table provides a quick overview of some of the key players in this space.

| Platform/Broker | Transaction Fee | Buyer Network | Verification Process | Payment Security |

| Example Platform 1 | Varies based on transaction size | Retail investors, HNI's, Institutions | KYC/AML checks, background verification | Escrow accounts, secure payment gateways |

| Example Platform 2 | 2% of transaction value | Primarily retail investors | KYC verification | Secure payment gateways |

| Example Broker 3 | Negotiable, typically 1-3% | HNI's, family offices | In-depth background checks, financial verification | Escrow accounts, secure transactions |