Unlisted shares represent equity in companies that are not traded on major public stock exchanges like the Bombay Stock Exchange (BSE) or the National Stock Exchange (NSE). Instead, these shares are transacted privately through brokers, investment firms, or specialized platforms dedicated to unlisted securities. They can be issued by startups, well-established private companies, or even firms that are preparing for a public listing in the future. For investors, unlisted shares offer unique opportunities and challenges, making it essential to understand their types and the nuances associated with each.

While unlisted shares can provide early access to high-growth companies, they also come with significant liquidity constraints, valuation uncertainties, and regulatory considerations. In this guide, we take an unbiased look at the main types of unlisted shares, outlining the key factors an investor should consider before diving into this segment of the market. [Read on how to buy Unlisted Shares in India]

1. Pre-IPO Shares

Pre-IPO shares belong to companies on the verge of going public. These shares are often made available to institutional investors, high-net-worth individuals, or venture capitalists well before the company’s Initial Public Offering (IPO). The idea is that by investing early, one can benefit from the anticipated price appreciation once the company begins trading on public markets. [Explore the Pre-IPO Investment Strategies]

Key Considerations

- Market Sentiment and Timing: One of the biggest uncertainties is the timing of the IPO. A delay, or worse, a cancellation, can affect the expected liquidity and valuation.

- Valuation Methodology: Since there is no daily market price, valuations are typically determined by recent funding rounds, internal performance metrics, and comparisons to similar public companies. This may sometimes lead to discrepancies between private and public valuations.

- Lock-In Periods: Many pre-IPO investments come with lock-in periods, meaning that even after the company goes public, investors may be required to hold their shares for a set duration.

- Regulatory Environment: Changes in regulatory guidelines or market conditions can influence the IPO timeline and investor exit strategies.

➢ Early Access: Investors can secure a position in a promising company before it reaches a wider audience.

➢ High Growth Potential: If the company performs well post-IPO, the potential for significant capital gains is substantial.

Risks:

➢Liquidity Constraints: Pre-IPO shares are illiquid until the company lists publicly.

➢Valuation Uncertainty: Without the transparency of public markets, determining a fair price can be challenging.

Consider a tech startup that has successfully secured multiple funding rounds. Investors who obtained pre-IPO shares early might have seen significant returns if the company’s eventual public listing resulted in a sharp price increase. However, if market conditions shifted or the IPO was delayed, these investors could have faced prolonged periods of illiquidity and uncertainty.

2. Startup Equity

Startup equity is a type of unlisted share offered by early-stage companies to raise capital. Often, these companies are in the midst of developing their product or service and require funding to accelerate growth, expand operations, or enhance technology. In exchange for early financial support, investors receive equity that may turn highly valuable if the startup succeeds.

Key Considerations

- High-Risk, High-Reward: Startups are characterized by high volatility. While the potential returns can be enormous if the company scales rapidly, the inherent risks of unproven business models and market competition are significant.

- Due Diligence: Investors need to assess the startup’s business plan, management team, competitive landscape, and revenue model. Lack of historical financial performance makes due diligence critical.

- Market and Technology Risks: Startups often operate in fast-paced, dynamic industries. Technological disruptions, changing consumer preferences, or regulatory changes can affect the business model.

- Exit Strategies: Unlike public companies, startups might not offer a clear path to liquidity. Potential exits could be via acquisition, secondary market transactions, or eventually through an IPO.

➢Potential for Exponential Growth: Early investors may realize significant returns if the startup scales successfully.

➢Influence on Strategy: In some cases, early-stage investments allow investors to provide strategic guidance and even participate in governance.

Risks:

➢High Failure Rate: Many startups do not survive beyond the initial stages, leading to a total loss of investment.

➢Illiquidity: Without a public market, it can be challenging to sell startup equity when needed.

Angel investors and venture capitalists often invest in tech startups at their infancy. For instance, early backers in companies like Uber or Airbnb witnessed exponential growth as these companies disrupted their industries. However, many startups fail to secure subsequent rounds of funding or achieve sustainable revenue, illustrating the high-risk nature of such investments.

3. Private Equity Firm Holdings

Private equity (PE) firm holdings involve investments in established, privately held companies. These firms typically acquire significant stakes through investment funds or direct purchases, with the objective of restructuring, expanding operations, or repositioning the company for eventual public listing or sale.

Key Considerations

- Investment Horizon: PE investments are often long-term, with holding periods that can extend for several years. This requires a commitment to patience and a long-term outlook.

- Due Diligence and Valuation: Private equity firms conduct extensive due diligence to evaluate a company’s operational efficiency, market position, and growth potential. Valuations are based on comprehensive financial models and future projections.

- Capital Commitment: Investments in private equity often involve large capital outlays and may not be accessible to retail investors due to high minimum investment requirements.

- Operational Involvement: PE firms typically take an active role in managing their portfolio companies, driving operational improvements and strategic restructuring.

➢ Operational Improvements: Active management and restructuring can lead to significant improvements in company performance and valuation.

➢ Diversification: Exposure to established companies that are not available in public markets can offer diversification benefits.

Risks:

➢ Long Lock-In Periods: The extended investment horizon can limit liquidity and flexibility.

➢ Market and Operational Risks: Even well-managed companies can face unforeseen challenges, from economic downturns to industry-specific disruptions.

A private equity firm may acquire a stake in a profitable manufacturing company that is not publicly listed. Through strategic investments in technology and operations, the firm can drive improvements and eventually realize a lucrative exit by selling the company or taking it public. However, the long holding period and capital-intensive nature of such investments mean that the risks must be carefully managed.

4. Employee Stock Ownership Plans (ESOPs)

Employee Stock Ownership Plans (ESOPs) are programs where companies offer their employees an opportunity to own shares as part of their compensation. These shares are typically unlisted and provide a direct financial stake in the company’s success. ESOPs are used to align the interests of employees and shareholders, incentivizing employees to contribute to the company’s long-term performance.

Key Considerations

- Vesting Schedules: ESOP shares often come with vesting periods, meaning employees earn the right to sell a certain percentage of shares over time. This structure is intended to retain talent and encourage long-term commitment.

- Tax Implications: The sale of ESOP shares can trigger tax liabilities. Employees must understand the taxation rules applicable to capital gains or dividend income derived from these shares.

- Market Value Determination: In the absence of a public market, companies typically conduct periodic valuations to determine the fair market value of ESOP shares.

- Liquidity Constraints: Just like other unlisted shares, ESOPs face liquidity challenges. Employees may have limited opportunities to sell their shares unless a liquidity event, such as an IPO or acquisition, occurs.

➢ Alignment with Company Goals: ESOPs motivate employees by aligning their financial interests with the company’s success.

➢Wealth Creation: For employees, ESOPs can serve as a powerful tool for wealth creation if the company grows and becomes more valuable.

Risks:

➢Lack of Liquidity: The inability to quickly convert shares into cash can be a significant drawback, especially during economic downturns.

➢Valuation Uncertainty: Periodic valuations may not always reflect market realities, leading to potential discrepancies in perceived value.

A technology firm might offer ESOPs to its employees during its early growth phase. As the company matures and perhaps prepares for an IPO, employees holding vested shares may experience a substantial increase in the value of their holdings. However, if the company struggles to achieve public market success, the ESOP shares may remain illiquid and undervalued.

5. Preference Shares

Preference shares are a distinct class of equity that differs significantly from common shares. These shares generally offer a fixed dividend payout and have priority over common shares when it comes to dividend distribution and asset liquidation. However, in most cases, preference shareholders do not possess voting rights, which can limit their influence over company decisions.

Key Considerations

- Dividend Priority: Preference shares are attractive for investors who value regular income because dividends are paid out before any distributions to common shareholders.

- Convertible Features: Some preference shares come with the option to convert into common shares. This convertibility feature can provide a path to capital appreciation, though it may dilute voting power.

- Voting Rights: The limited voting rights mean that while preference shares are more secure in terms of income, investors have less control over corporate governance and strategic decisions.

- Risk Profile: The fixed dividend structure often translates into lower volatility compared to startup or common equity investments. However, the upside potential is usually capped compared to common shares.

➢ Stable Income: Preference shares are well-suited for conservative investors looking for predictable returns.

➢ Lower Risk Profile: In many cases, the fixed-income nature of preference shares provides a cushion during market downturns.

Risks:

➢ Limited Capital Appreciation: The capped upside may not match the potential returns of more volatile equity investments.

➢Lack of Control: The absence of voting rights means preference shareholders have little say in company decisions, which could be problematic in scenarios of strategic shifts or management changes.

An established private firm may issue preference shares to attract capital without diluting control over management. Investors seeking a steady income stream may prefer these shares, knowing that they have a higher claim on dividends compared to common shareholders. Nonetheless, if the company’s growth outpaces the fixed dividend, these investors might miss out on larger capital gains that common equity holders enjoy.

6. Founders' Shares

Founders' shares are unique to the founding team of a company and are structured to preserve control even as new investors come on board. These shares typically come with enhanced voting rights, ensuring that the original founders can guide the company’s strategic direction despite dilution from subsequent funding rounds.

Key Considerations

- Enhanced Voting Rights: The main advantage of founders' shares is the ability to retain decision-making power. This is crucial during periods of rapid growth or strategic pivots.

- Transfer Restrictions: Often, founders' shares come with restrictions on transferability to prevent a rapid dilution of control.

- Long-Term Vision: These shares reflect a long-term commitment to the company’s mission, which can be reassuring for investors looking for stability in leadership.

- Potential Conflicts: As more external investors come into the picture, the preferential treatment of founders' shares can lead to conflicts over governance and strategic direction.

➢ Control: Founders can maintain a significant influence over major decisions, which can be critical for the company’s long-term success.

➢ Alignment of Interests: The founders’ commitment, as evidenced by their share structure, often instills confidence in other investors.

Risks:

➢ Dilution Issues: In subsequent funding rounds, the relative value of founders' shares can be diluted, even if voting power is preserved.

➢ Limited Liquidity: Like other unlisted shares, founders’ shares can be challenging to sell or convert into cash, particularly if the company remains private for an extended period.

In the technology sector, many startups structure their founders’ shares to ensure that the original team maintains control even as venture capital investors come in. While this arrangement has helped companies like Facebook and Google secure a consistent strategic vision, it also means that founders may face liquidity issues until a major exit event, such as an IPO or acquisition, occurs.

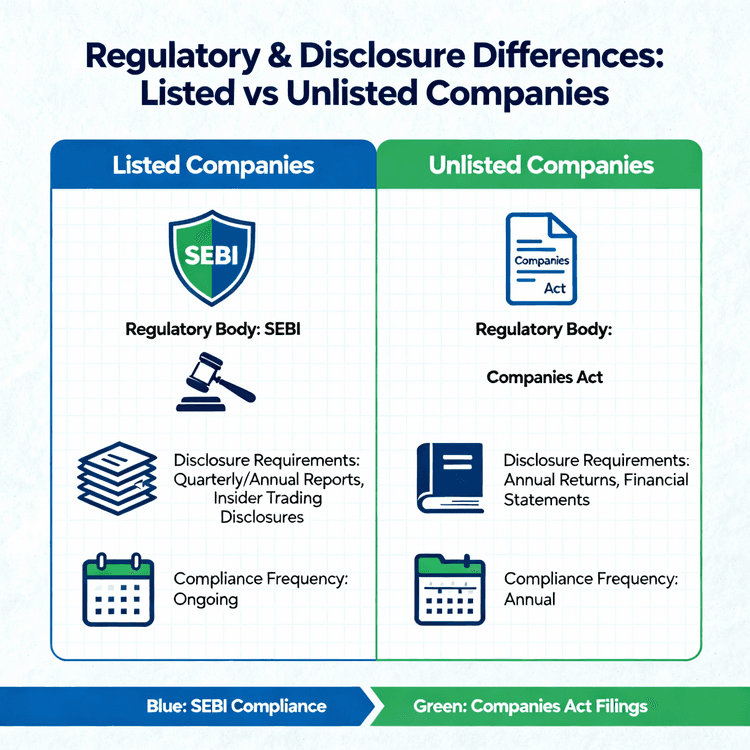

7. Delisted Shares

Delisted shares are those that were once publicly traded but have been removed from major stock exchanges. Delisting can occur for several reasons, such as mergers and acquisitions, failure to meet regulatory requirements, or a strategic decision by the company to go private. Although delisted, these shares continue to be traded privately.

Key Considerations

- Liquidity Constraints: Once a company is delisted, the public market for its shares vanishes, and trading is confined to private or over-the-counter markets, making exit strategies more complicated.

- Reasons for Delisting: Investors should thoroughly investigate the reasons behind a delisting. Was it due to poor financial performance, regulatory issues, or a strategic move to restructure away from public scrutiny?

- Valuation Challenges: Without the transparency of a public market, determining the fair market value of delisted shares requires reliance on periodic private transactions or company disclosures.

- Regulatory Implications: Companies that have been delisted may face a different regulatory environment, affecting how investors are protected and how information is disclosed.

➢ Potential for Turnaround: Some companies may be delisted as part of a strategic turnaround. Investors who believe in the company’s long-term prospects might see significant upside if the business improves.

➢Undervalued Opportunities: In certain cases, delisted shares may be trading at a discount, offering an entry point for investors willing to take on additional risk.

Risks:

➢ High Uncertainty: The lack of public market data can make it difficult to assess the true value and risk profile of the company.

➢Exit Challenges: Limited liquidity means that even if the investment performs well, converting shares into cash can be problematic.

A company that was delisted due to regulatory concerns might still be fundamentally sound, operating profitably in a niche market. Investors who conduct deep due diligence and believe in a potential regulatory resolution may find an attractive opportunity. However, the illiquidity and uncertainty surrounding the delisting process are critical risks that need to be managed carefully.

In the world of unlisted shares, due diligence is paramount. Investors should conduct comprehensive research into a company’s financial health, management quality, market dynamics, and regulatory environment before investing. Because each type of unlisted share caters to different investment strategies—whether the goal is early access, steady income, or strategic influence, it’s essential to tailor one’s approach based on personal risk tolerance, investment horizon, and overall portfolio strategy.

Moreover, the landscape for unlisted securities is continuously evolving, driven by market innovations, regulatory changes, and emerging economic trends. Staying informed and consulting with financial experts can help investors navigate these complexities and make sound, well-informed decisions.

By understanding the distinct features and trade-offs associated with each type of unlisted share, investors can better position themselves to capitalize on opportunities while mitigating the inherent risks of this market segment.