Unveiling the Two Sides of the Share Market

Understanding the difference between listed and unlisted shares is crucial for making informed investment decisions. This listicle outlines six key distinctions: listing requirements, liquidity, regulations, financing options, valuation, and ownership structure. Whether you're a seasoned investor or new to the market, grasping these core concepts will empower you to navigate the complexities of listed and unlisted shares, particularly within the Indian market, and optimize your investment strategy. This guide will cover examples relevant to NSE shares and companies like Apollo Green, Polymatech, VCI Chemicals, and Urban Tots, helping you understand the nuances of both listed and unlisted shares in India.

1. Listing on Stock Exchanges

A key difference between listed and unlisted shares lies in their accessibility through stock exchanges. Listed shares are securities that have been officially admitted for trading on a regulated stock exchange like the National Stock Exchange of India (NSE) or the Bombay Stock Exchange (BSE). This admission follows a stringent registration process with securities regulators, requiring companies to meet specific criteria, including minimum market capitalization requirements. This listing process allows these shares to be readily bought and sold by the public during exchange trading hours, providing investors with a regulated and transparent marketplace governed by standardized trading rules. In contrast, unlisted shares belong to companies that haven't undergone this formal listing procedure and, therefore, are not traded on established stock exchanges.

This distinction is crucial for several reasons and deserves a prominent place in any discussion about the differences between listed and unlisted shares. Listing provides significant advantages to both the company and investors. For companies, it creates a liquid market for their shares, facilitating easy buying and selling. This liquidity leads to a readily available and transparent market valuation, which can be vital for future fundraising efforts and overall financial planning. Listing also enhances a company's prestige and visibility, attracting wider investor interest and potentially boosting its brand image. For existing shareholders, listing provides a clear pathway to monetize their holdings by selling shares on the open market. Furthermore, companies gain access to additional capital through secondary offerings, allowing them to fund expansion plans and other strategic initiatives. Examples in the Indian context include companies like Reliance Industries and Tata Consultancy Services listed on the BSE/NSE. Globally, we see prominent listings on exchanges like the New York Stock Exchange (NYSE) featuring companies like Apple and IBM, the technology-focused NASDAQ with listings like Microsoft and Amazon, and the London Stock Exchange (LSE) hosting companies such as HSBC and GlaxoSmithKline.

However, listing is not without its drawbacks. The listing process itself is expensive, involving substantial underwriting fees, legal costs, and other associated expenses. Once listed, companies face ongoing compliance costs to adhere to the regulations of the exchange. The requirement for regular financial reporting (typically quarterly and annually) can create short-term market pressures, with share prices fluctuating based on these reports. Listing also results in a loss of privacy and control, as the company becomes subject to greater public scrutiny. Finally, listed companies are potentially vulnerable to hostile takeovers, as any investor can acquire shares on the open market.

For companies considering listing, it’s critical to carefully evaluate their readiness for public scrutiny and ensure robust financial reporting systems are in place. Building a strong management team with public company experience is essential. Engaging experienced underwriters and legal advisors is also highly recommended. Finally, companies should carefully consider the optimal timing for listing, taking into account prevailing market conditions. This careful consideration of the pros and cons of listing is essential for both Indian companies looking at the NSE and BSE, and for businesses worldwide exploring international exchanges. Whether you are an experienced investor, a first-time investor, an institutional player, a wealth management professional, or an industry analyst, understanding the implications of listing is fundamental to navigating the complexities of the share market. Even for those specifically interested in the unlisted shares market, understanding the listed market provides a valuable benchmark and context for comparison.

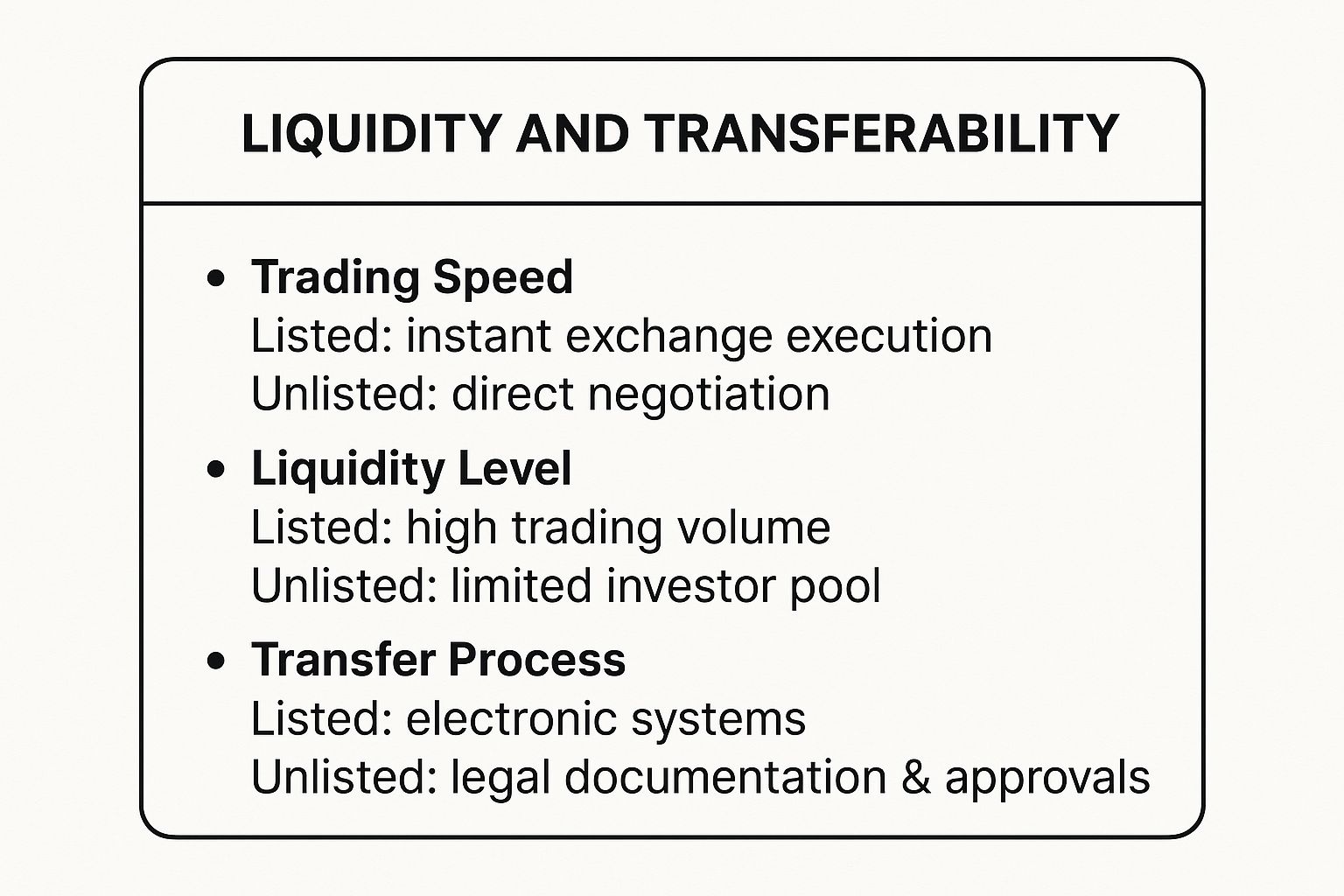

2. Liquidity and Transferability

A crucial point of distinction between listed and unlisted shares lies in their liquidity and transferability. This essentially refers to how easily you can buy or sell the shares. Listed shares, traded on stock exchanges like the NSE, enjoy high liquidity due to the established infrastructure. Electronic trading systems facilitate near-instant execution of trades, with transparent bid-ask spreads and market makers ensuring ample liquidity. This means you can buy or sell listed shares quickly and easily at a fair market price. Conversely, unlisted shares are not traded on exchanges, making their transfer significantly more complex. Transactions often involve direct negotiation between buyer and seller, extensive legal documentation, and sometimes even require approval from the company's board. This process can be time-consuming and challenging, particularly for investors in India seeking a quick exit. This difference is paramount for investors considering their investment strategy and exit options.

The infographic above provides a quick reference summarizing the key differences in liquidity and transferability between listed and unlisted shares. It visually highlights the ease of trading listed shares versus the complexities and potential delays associated with unlisted share transactions. This contrast underscores the importance of understanding these characteristics before investing.

undefined

This difference in liquidity significantly impacts investor experience. For listed shares, such as those of Facebook (now Meta), millions of shares exchange hands daily with near-instantaneous settlement. This allows investors an easy exit opportunity at any time, contributing to price discovery through continuous trading. Listed shares can also be readily used as collateral for loans. However, this liquidity also exposes investors to market volatility and potential speculation. Remember events like the March 2020 COVID crash, which triggered stock market circuit breakers due to extreme volatility? Listed shares are directly impacted by such market fluctuations.

On the other hand, unlisted shares, like those of SpaceX or Chick-fil-A (despite its size), involve private transactions at negotiated prices and a limited pool of potential investors. While this allows companies like Chick-fil-A to maintain family ownership and a stable shareholder base without daily price fluctuations, it creates difficulties for investors seeking to exit their investments. Unlisted shares also often carry an illiquidity discount on their valuation, and determining a fair market value can be a challenge. Learn more about Liquidity and Transferability, particularly within the Indian context. This resource provides valuable insights into navigating the complexities of selling unlisted shares in India.

Key Takeaways:

- Listed Shares: High liquidity, easy transferability, real-time pricing, market volatility.

- Unlisted Shares: Low liquidity, complex transferability, negotiated pricing, price stability.

Tips for Investors:

- Unlisted Shares: Negotiate exit rights within shareholder agreements and explore the possibility of internal share buyback programs.

- Listed Shares: Use trading volume as a key indicator of true liquidity.

- Unlisted Companies: Consider creating periodic private liquidity events.

- All Investors: Utilize specialized brokers for trading unlisted shares whenever possible.

3. Regulatory Compliance and Disclosure Requirements

A key difference between listed and unlisted shares lies in the regulatory landscape they inhabit. This distinction significantly impacts transparency, investor protection, and the overall operational burden on the company. Understanding these differences is crucial for making informed investment decisions. Listed companies operate under a stringent regulatory framework enforced by bodies like the Securities and Exchange Board of India (SEBI), demanding extensive and regular disclosures. This ensures market transparency and protects investor interests. Conversely, unlisted companies enjoy greater confidentiality due to significantly reduced regulatory oversight, but this comes at the cost of less investor protection.

For companies with listed shares, adhering to strict regulations and disclosure requirements is paramount. Understanding the nuances of financial public relations is essential for navigating this complex landscape. Source: Financial Public Relations: Proven Strategies from Blackbird Digital. Listed companies are obligated to follow standardized financial reporting schedules, immediately disclose material information, adhere to strict regulations on insider trading, and comply with corporate governance codes. This transparency fosters investor confidence by providing standardized information for investment analysis and promoting robust corporate governance. However, these benefits come at a price. Compliance costs can be substantial, estimated at $1-2 million annually for mid-sized companies. Furthermore, the mandatory disclosure of sensitive business information can expose companies to competitive pressures. The risk of regulatory penalties for non-compliance adds another layer of complexity.

Unlisted companies, on the other hand, have minimal public disclosure requirements, submitting private financial reports only to their shareholders. This confidentiality protects their business strategies from competitors and translates to lower compliance costs. Management also enjoys greater freedom from short-term market pressures, allowing them to focus on long-term growth strategies. However, this lack of transparency can breed investor uncertainty due to information asymmetry. Unlisted companies also face limited access to capital markets, hindering their growth potential. Governance issues can also arise due to less regulatory oversight.

Examples of these differing regulatory landscapes are readily apparent. In the US, the Sarbanes-Oxley Act holds listed companies accountable for accurate financial reporting, following major accounting scandals. The SEC regularly takes enforcement actions against companies for disclosure violations. Conversely, large unlisted companies like Koch Industries operate without public financial disclosure. Listed companies regularly engage in activities like quarterly earnings calls and investor presentations, a testament to their transparency obligations. Learn more about Regulatory Compliance and Disclosure Requirements

Whether you are considering investing in Apollo Green Shares, Polymatech Shares, VCI Chemicals, Urban Tots, or other NSE unlisted shares, or are interested in NSE listed shares, understanding these regulatory nuances is essential. For companies considering listing, developing robust compliance systems and budgeting adequately for compliance costs are critical pre-IPO steps. Weighing the competitive impact of required disclosures is equally crucial. Unlisted companies seeking to attract quality investors should maintain strong voluntary governance and establish clear insider trading policies. This proactive approach mitigates potential governance concerns and instills investor confidence. The regulatory environment plays a defining role in the difference between listed and unlisted shares, impacting everything from transparency and investor protection to access to capital and long-term growth potential. This factor makes understanding the regulatory landscape an essential step for both companies and investors.

4. Capital Raising and Financing Options

A critical difference between listed and unlisted shares lies in how companies leverage them for capital raising and financing. This distinction significantly impacts a company's growth trajectory, financial flexibility, and investor relations. Understanding these financing options is crucial for both companies deciding on their share structure and investors evaluating investment opportunities.

Listed companies enjoy the advantage of accessing public markets. They can raise capital through Initial Public Offerings (IPOs), where shares are offered to the public for the first time, and follow-on offerings, where additional shares are issued to existing and new investors. This access to a broad investor base, ranging from retail investors to large institutional players, allows listed companies to raise substantial capital. Furthermore, listed shares can be used as acquisition currency, facilitating mergers and acquisitions. The readily available market valuation of listed shares also simplifies the process of granting employee stock options with a clear and transparent value.

Unlisted companies, on the other hand, operate within a different financial landscape. Their capital raising options primarily involve private placements to accredited or sophisticated investors, venture capital funding rounds, private equity investments, and traditional debt financing. While these avenues might offer more flexible investment terms and fewer regulatory hurdles, the investor pool is inherently smaller. Negotiating shareholder rights can also be more complex in the private market.

Features:

- Listed: Public offerings (IPOs and follow-on offerings), use of shares as acquisition currency, employee stock options with clear market value.

- Unlisted: Private placements, venture capital and private equity funding, strategic corporate investors.

- Listed: Access to larger pools of capital, typically lower cost of capital, ability to raise funds even when debt markets are constrained.

- Unlisted: More flexible investment terms, fewer regulatory hurdles for fundraising, no dilution pressure from public markets.

- Listed: Market timing risks for offerings, dilution visibility affecting share price, public scrutiny of capital allocation decisions.

- Unlisted: Limited investor pool, potentially higher cost of capital, complex shareholder rights negotiations.

- Listed: Tesla's $5 billion capital raise in 2020 through an at-the-market offering, secondary offerings by public REITs to fund property acquisitions.

- Unlisted: Epic Games raised 600 million private funding round valuing it at $95 billion. For a closer look at the Indian market, consider how pre-IPO companies like Tata Capital operate before listing. Learn more about Capital Raising and Financing Options.

- Consider a dual-track process (IPO preparation alongside private funding negotiations).

- For unlisted companies, build relationships with private equity and VC firms early.

- Public companies should maintain shelf registrations for opportunistic capital raising.

- Unlisted companies should consider convertible notes to defer valuation discussions.

- Evaluate SPAC mergers as an alternative listing pathway.

5. Valuation Methods and Price Discovery

A critical difference between listed and unlisted shares lies in how they are valued and how their prices are discovered. This distinction significantly impacts investment decisions, especially for Indian investors interested in NSE shares, unlisted shares, or specific companies like Apollo Green Shares, Polymatech Shares, VCI Chemicals, and Urban Tots. Understanding these valuation nuances is crucial for experienced investors, first-time investors, institutional investors, wealth management professionals, industry analysts and advisors alike.

Listed shares benefit from the continuous price discovery mechanism of a public exchange. Trading activity generates real-time valuations based on supply and demand, reflected in the readily available metric of market capitalization. This constant price discovery brings transparency and certainty to transactions. Think of NSE-listed stocks – their prices are updated every second, giving a clear picture of their current market value. Public multiples like Price-to-Earnings (P/E) and Enterprise Value-to-EBITDA (EV/EBITDA) are commonly used to compare listed companies within a sector.

Unlisted shares, however, are valued periodically, often using financial models like Discounted Cash Flow (DCF) analysis, comparable company analysis, or negotiated prices between private parties. This can result in less frequent and potentially less precise valuations. For instance, when considering investments in unlisted companies like those mentioned above, the valuation process relies more on projections and comparisons than real-time market data. In niche industries, finding truly comparable companies can be challenging, adding to the complexity. Learn more about Valuation Methods and Price Discovery.

Pros and Cons:

- Listed Shares:

- Unlisted Shares:

- Listed: Tesla's market capitalization exceeding the combined value of traditional automakers despite lower production illustrates how market sentiment can drive valuations. Daily mark-to-market valuations of listed shares directly impact investment fund performance.

- Unlisted: Discord rejecting Microsoft's $10 billion offer based on private valuation expectations highlights the role of negotiation and future growth projections in unlisted company valuations. Private company valuations play a key role in tender offers by secondary market funds.

- Unlisted Companies: Use multiple valuation methods and consider engaging independent valuation experts. Account for control premiums or minority discounts in transactions. Implement formal valuation policies for employee equity.

- Listed Companies: Focus on long-term fundamentals despite short-term price movements.

6. Ownership Structure and Corporate Control

A critical difference between listed and unlisted shares lies in how they shape a company's ownership structure and influence control dynamics. This factor is crucial for investors in India and globally, particularly those interested in NSE shares, unlisted shares, or specific companies like Apollo Green, Polymatech, VCI Chemicals, or Urban Tots, as it directly impacts their level of influence and the potential risks involved. Understanding this distinction is fundamental for experienced investors, first-time investors, institutional investors, wealth management professionals, and industry analysts alike.

Listed companies generally have a dispersed shareholder base, meaning their shares are widely held by a mix of institutional investors (like mutual funds and pension funds) and retail investors. This broad ownership often leads to a separation of ownership and management. While shareholders own the company, day-to-day operations are handled by a professional management team. This structure allows for diverse perspectives and professional oversight but can also make the company vulnerable to activist investors and hostile takeovers. For example, dual-class share structures, like those used by Facebook (now Meta) and Google (now Alphabet), allow founders to retain significant voting rights even with dispersed ownership, highlighting the strategic maneuvering around control within listed entities. Furthermore, listed companies are subject to proxy voting mechanisms, offering shareholders a formal way to participate in company decisions.

Unlisted companies, on the other hand, typically maintain concentrated ownership. Founders, families, or a small group of investors usually retain significant control, influencing the company's strategic direction. This concentrated ownership can foster aligned long-term interests and enable quick decision-making without the pressure of quarterly earnings reports and market fluctuations. However, it can also lead to potential issues like majority shareholder oppression and challenges with succession planning. Strong founder/family control, as exemplified by Mars Inc., one of the world's largest private companies, allows for long-term vision execution but can limit minority shareholder protections. Detailed shareholder agreements, common in unlisted companies, govern control and decision-making processes, often addressing potential deadlocks and disputes.

Pros and Cons:

Listed:

- Pros: Diverse perspectives, professional institutional oversight, liquidity for employee ownership plans

- Cons: Vulnerability to hostile takeovers, pressure from short-term focused investors, proxy fights disrupting operations

- Pros: Aligned long-term interests of owners, quick decision-making without market pressure, preservation of founding vision and culture

- Cons: Potential for majority shareholder oppression, succession planning challenges, limited minority shareholder protections

- Listed: Dual-class share structures (Facebook/Google), activist campaigns (Carl Icahn, Engine No. 1 targeting ExxonMobil)

- Unlisted: Mars Inc. maintaining family control, Dell's going-private transaction to regain strategic control

- Considering Listing: Explore dual-class structures to potentially maintain founder control.

- Corporate Governance: Prioritize strong corporate governance practices regardless of listing status.

- Unlisted Companies: Ensure clear shareholder agreements addressing deadlocks and dispute resolution.

- Listed Companies: Maintain proactive investor relations.

- Buy-Sell Provisions: Establish buy-sell provisions for unlisted company shares to facilitate exit strategies.

6 Key Differences Between Listed and Unlisted Shares

| Aspect 🔍 | Listing on Stock Exchanges 🔄 | Liquidity and Transferability ⚡ | Regulatory Compliance and Disclosure 📊 | Capital Raising and Financing Options ⭐ | Valuation Methods and Price Discovery 📊 | Ownership Structure and Corporate Control 💡 |

| Implementation Complexity 🔄 | High: formal registration, ongoing compliance costs | Medium: requires trading infrastructure or negotiation | High: extensive disclosure and governance requirements | Medium-High: IPO process or private funding negotiations | Medium: continuous market pricing vs periodic valuations | Medium: dispersed vs concentrated ownership management |

| Resource Requirements 📊 | Significant legal, financial, and advisory resources | Trading systems and legal support for transfers | Dedicated compliance teams and reporting systems | Investment banks, underwriters, legal counsel | Valuation experts and financial analysts | Governance frameworks and shareholder agreement drafting |

| Expected Outcomes ⭐ | Liquid market, clear valuation, prestige | Instant liquidity for listed; limited for unlisted shares | Transparency and investor confidence vs confidentiality | Access to broad capital pools vs flexible private funding | Real-time market prices vs negotiated valuations | Broadened investor base and control challenges |

| Ideal Use Cases 💡 | Established companies seeking public capital and liquidity | High liquidity needs or investor exit options | Public companies requiring transparency and investor trust | Growth companies needing large-scale capital | Companies needing continuous valuation for trading | Founder-led or family businesses prioritizing control |

| Key Advantages ⭐ | Liquidity, market visibility, capital access | Ease of share transfer, collateral use vs control over shareholders | Investor protection, market trust vs lower costs and discretion | Lower cost of capital and wider investor access vs flexibility | Transparent pricing with market feedback vs valuation flexibility | Diverse ownership oversight vs aligned long-term control |