NSDL Stamp Duty Payment for Shares and Securities Transactions

The National Securities Depository Limited has completely turned around the way stamp duty is collected and administered in the Indian capital markets. This digital upgrade makes the procedure of compliance paperless as well as transparent across all the securities transactions. This is where the necessity of acknowledging the NSDL Stamp Duty Payment system arises for entities involved in the market today such as investors, corporates and intermediaries.

What is NSDL Stamp Duty Payment?

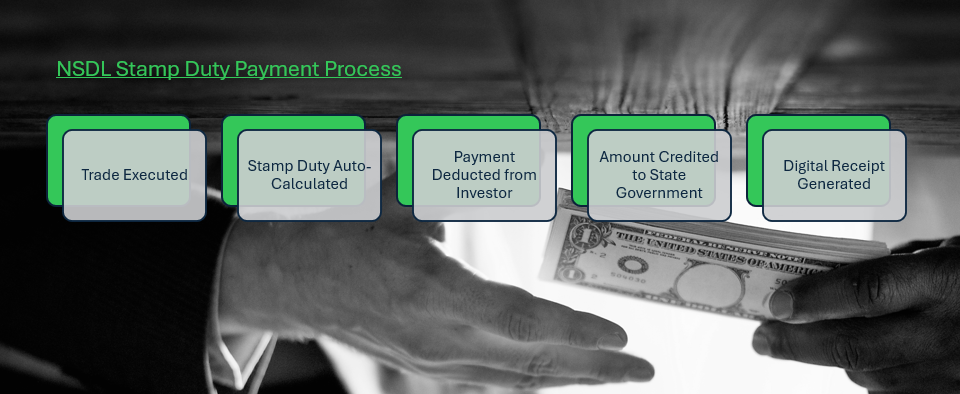

NSDL stamp duty payment is a digital mode to collect and pay stamp duty on securities transactions as per the government's directives to the relevant state governments. This mechanism serves as a single platform for investors to pay stamp duty on transactions across listed equities, bonds (debentures), derivatives and other marketable securities as defined by the Government of Maharashtra.

The system operates as a fully integrated solution, with stamp duty being automatically calculated and collected at transaction settlement.

Stamp Duty for Investors

When you are trading from your demat account, the stamp duty applicable will be automatically deducted and paid off without any direct manual intervention. This computerized methodology guarantees that all dealings are conducted within the limits of the law and eases the bureaucratic load on the market participants.

Comprising a delivery-based and non-delivery mechanism for all types of securities transactions, whether in respect of those companies whose securities are listed on stock exchanges or those where shares dealt with are not listed and the transaction is done on a private basis, the procedure of uniform collection by the NSDL system deprives the ALs of all the benefits that could be and perhaps were available hitherto through non-uniform collection depending not only on the state of availment but also on the state in which the transaction took place.

Why is Stamp Duty charged on shares and securities?

Stamp duty has played a successful role as a legal adjudication and validation process in giving legality to transfers of ownership in the securities market. The government-mandated tax also ensures that every transaction is formally documented and accounted for under Indian law, providing a clear audit trail for regulators.

The main objective is not merely the collection of revenue but also investor protection and market integrity. Regulators can use payment of stamp duty as a means of tracking the transfer of ownership or preventing fraudulent transfers and establishing clear records of ultimate beneficial ownership. The result is a safe and secure investment environment in the capital market, as you can be sure your rights are legally secured.

Before July 2020, stamp duty rates differed greatly between Indian states, which was both cumbersome to comply with and offered arbitrage possibilities. The introduction of uniform rates through depository contribution to depositories like NSDL removed such disparities and brought in standardization in trading in securities. It is this consistency that allows all investors to be charged the same rates regardless of geographies or the geographical source of the securities traded.

➢ Stamp duty payment automatically imparts legal status to all transfers of ownership

➢ Governments of the states get their fair share of earnings from capital market transactions

➢ Market visibility is enhanced with all transactions being recorded and tracked digitally

➢ Investor trust grows as a consequence of a more homogeneous and controlled collection process

How to Make NSDL Stamp Duty Payment Online?

Convenient and secure online payment. The NSDL has developed the system to make stamp duty payments easy and efficient and to minimize errors in calculations and receipts. Investors can fulfill their stamp duty through various available modes, which results in a safe and fast transaction.

In case of online payment, users can log on to the official website and proceed to the NSDL stamp duty portal. Basic information about the transaction is needed by the system, namely security type, amount, price and total amount of consideration. As soon as this information has been entered, the system calculates the relevant stamp duty according to the current applicable rates and rules.

The payment begins with opening up the stamp duty calculator, available on the NSDL site. Users have to choose their transaction type: equity delivery, intraday, futures, options or off-market transfers. Once you add the transaction details, the system will show the calculated stamp duty fees as well as a list of payment options.

Payments can be made via various safe modes such as net banking, UPI transfers, debit cards or NEFT/RTGS transactions. For large-volume transactions or institutional customers, NSDL offers a virtual account facility whereby there is no payment gateway connection and the bank account can be transferred directly.

➢ Go to the official NSDL website and open the stamp duty tab

➢ Choose the type of transaction and input relevant information like quantity and consideration received

➢ Check that the calculation of stamp duty is correct

➢ Select your desired payment means available with security

➢ Finally pay and download the payment receipt for record purposes

➢ Please ensure all client information is entered correctly to prevent any processing delays

Applicable Stamp Duty Rates for Different Transactions

The existing stamp duty structure results in transparency and consistent rates throughout the Indian states, reducing prior complexity and non-compliance concerns. Those standard rates are always used, no matter where the investor is actually situated or where the securities traded are situated.

For equity deliveries, stamp duty is charged at 0.015% of the transaction value, and for intraday or non-delivery trades, stamp duty for equity trading is levied at 0.003%. They are only applied to the buy side, so the seller pays no stamp duty under the current system.

Derivatives are subject to a variety of different exchange or over-the-counter market rate structures, all of which are intended to take into account their levels of risk and other market factors. Equity futures get charged at 0.002% of the notional value and equity options at 0.003% of the premium. FX and interest rate derivatives will see reduced charges after reaching 0.0001% of the notional value, incentivizing the use of these critical hedging products.

The same rate as other delivery-based stock transactions is applied to off-market transactions (such as share transfers through inheritance, gifts or private transactions), which is 0.015 percent. This way every change or transfer of ownership, even if it is of an economic character, is justly subject to fiscal obligations and at the same time legal validity is preserved.

Pros of Paying Stamp Duty Through NSDL

The NSDL-based stamp duty collection system is a convenient and cost-effective method of complying with stamp duty requirements, and it simplifies and reduces the administrative burden of stamp duty-related record-keeping for all market participants. This value is passed on throughout the ecosystem, including individual and institutional investors as well as market intermediaries.

The collection of stamp duty in a centralized manner can result in automatic deduction of stamp duty at the time of settlement, thereby reducing the possibility of non-compliance or delay in payment. This automated process eliminates the headache of having to calculate fee rates, visit an office in person or keep track of separate payment records.

The electronic stamped receipt system verifies that the stamp duty is paid instantly and provides reports for real-time transactions. These electronic acknowledgments are proof of your compliance and can easily be retrieved for an audit or a regulatory inquiry. The permanent digital record increases transparency and avoids conflict among the involved people. Governments also more easily collect their stamp duty via automatic revenue collection. The NSDL system eliminates lag in collection and reduces the administrative overhead in terms of manual collection and reconciliation.

There will be lower compliance requirements on market intermediaries such as brokers, depository participants, clearing members and the Clearing Corporation as the system would handle its computation and collection. This gives them the freedom to concentrate on what they do best, supplemented by the complete peace of mind of legal compliance.

➢ Real-time settlement would remove AML checks and settlement risk

➢ Computerized calculations prevent human error and guarantee the accurate payment of duty

➢ Electronic audit trails to facilitate recordkeeping and regulatory reporting through access to permanent audit trails of digital records

➢ Lower admin costs help markets and intermediaries as well as investors

➢ The allocation of state revenue takes place automatically with no need for manual intervention

The most common issues and how to solve them

Notwithstanding the advanced features and functionality that may be available in the NSDL stamp duty system, an end user may experience technical and procedural difficulties that may necessitate compatibility. Knowing common issues along with their remedies is the key to smooth transaction processing and compliance maintenance.

Payment gateway down is one of the common technical problems encountered by users while making online payment of stamp duty. These declines are usually caused by network connection failures, downtime at the bank server or incorrect payment details entered by a user. In case of payment failure, users should also check bank account status, internet connectivity and retry through other payment modes. Virtual account number errors may result from individuals submitting institution clients or depository participant accounts in the wrong format for NEFT/RTGS. Proper format would expect certain prefixes before the exact client or DP number and no spaces or characters. Users must validate their account numbers as per the guidelines of the NSDL before transacting.

Transaction matching differences may occur if the stamp duty amount as per the users is not matching with the NSDL system. This often occurs due to incorrect transaction details being entered or when users use old rate information. Resolution is only upon the careful verification of the details of the transactions including security type, quantity and the rates.

So-called late acknowledgements may arise during high-volume trading when system processing has backlog issues. Users need to provide reasonable time for system processing and can contact the NSDL support services in case the receipts are not generated within reasonable periods.

➢ Failed payment: Check the bank statement and retry with other payment methods

➢ Virtual account issues: Verify if the data capture is correctly made without spaces or symbols

➢ Miscalculation: Double-check the exchange information and the rates involved

➢ Receipts lost in transition: Give it some time and if more time passes than expected, contact support

➣ Access system difficulties: Clear browser cache and verify that you are using compatible browser versions

Conclusion

The NSDL Stamp Duty Payment System is the convergence of technologies and the role of the two premier institutions of the country, RBI and SEBI, that has enabled a paradigm shift in the compliance regime in the securities markets of the country from that of a manual system to a secure, automated and centralized one. This digital framework will get rid of earlier anomalies and will foster uniformity in the application of stamp duty rates.

Investors and market participants, in addition to the convenience, accuracy and instant compliance confirmation, benefit from integrated payment processing and digital receipt creation. The automatic calculation function eliminates mistakes and saves the administrative burden for securities transactions from every party.

The uniform rate system offers transparency and predictability in stamp duty liabilities, facilitating better cost planning for investors and institutions. From equity trades through to derivative transactions and off-markets, participants can be confident in the consistency and transparency of duty calculations, which facilitate decision-making.

In the future, the NSDL stamp duty system is further developing the service to adapt to evolving market requirements while preserving the basic principles of transparency, efficiency and compliance. This strong foundation fosters India’s burgeoning capital markets and ensures the correct revenues for state governments and the legal sanctity of all securities transactions.