What Is a Listed Company?

A listed company is one, where equity shares or debt instruments are listed on one or more regulated stock exchanges including the National Stock Exchange (NSE) or the Bombay Stock Exchange (BSE) in India. In order to attain and retain this status, a firm should meet requirements of high eligibility standards that are set by the Securities and Exchange Board of India (SEBI) and the concerned exchange. Such requirements usually entail a set minimum number of shares paid in capital, a specified history of paying out distributable profits in the past years and a wide distribution of stockholding pattern that guarantees a minimum public float.

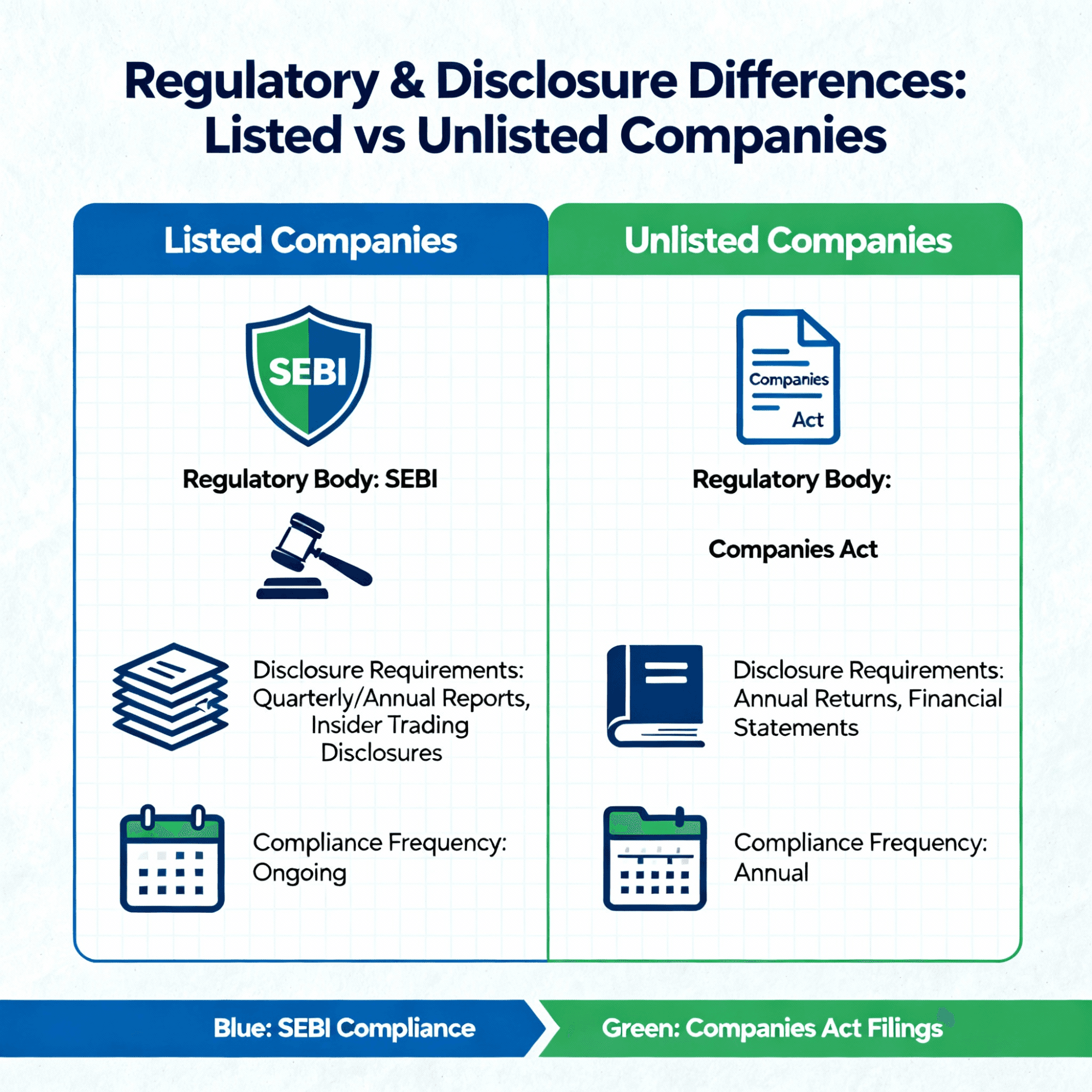

The company must also comply with continuous requirements once it is listed. It should submit audited quarterly and annual financial reports, shareholding transactions, material and corporate events and compliance with insider-trading and corporate governance practices. The continuous auction mechanism of the exchange offers the transparent price discovery where investors trade, selling and buying shares at the market-based prices in the trading sessions. The environment in which listed companies operate is characterized by improved liquidity, strong regulatory governance, and increased access of the investor.

What Is an Unlisted Company?

An unlisted company does not trade its securities on any formal stock exchange. Its shares remain in the hands of private investors, founders, promoters, employees, and selected strategic or institutional investors. Such companies include family-owned businesses, private equity-backed enterprises, closed-group entities, and startups in early growth phases. They raise capital through private placements, venture capital, angel investors, or employee stock option plans rather than public issues.

Unlisted companies are bound to the Companies Act, 2013 and other rules, but are not affected by the continuous disclosure requirements of listed companies. They are at most required to make and submit annual audited financial statements to the Registrar of Companies (RoC). No one is required to declare quarterly performance, release shareholding structure, and/or get shareholders to approve regular fundraising. As a result, the level of information asymmetry is higher and valuation remains based on negotiated terms each time a funding round is done or an internal valuation exercise is done by investors and professional valuers.

Unlisted companies can only transfer ownership through formal share transfer agreements and board resolutions. One of the characteristics is illiquidity of shares because there is no centralized trading to find buyers and sellers. Secondary transfers frequently happen via private deals or specialised systems that can trade in unlisted shares using regulatory arrangements, but are still small when compared with stock markets.

Difference Between Listed and Unlisted Company

Even though both the listed and unlisted companies are aimed at profit-making and growth, they are basically different in several dimensions:

- Exist Mechanisms and Liquidity: The stock exchanges allow investors easy exit options by listed companies, which ensures that trading will occur during the market hours and at the transparent market prices. Unlisted corporations do not have this open market, and thus these types of investors depend on the occasions of liquidity, e.g., a private buyback, institutional round, or an eventual IPO to sell their investments. Therefore, years on years the unlisted shareholdings can be held captive.

- Valuation Methods: Listed shares are valued in real time through the supply and demand of shares on the market which displays an indication of real-time investor sentiment and macro-economic considerations. Unlisted shares are appraised periodically, either at the most recent price of a funding round, or at a discounted cash flow analysis, or at some analogous company valuation. Such periodic valuations can be significantly different to intrinsic or current market value.

- Burden of Regulatory and Compliance: Listed firms get voluminous rulebooks, Listing Obligations and Disclosure Requirements of SEBI (LODR), codes of corporate conduct, insider-trading rules and obligatory event-related disclosures. Exchange fee, listing fee, preparation of detailed disclosure, non-compliance penalties are some of the compliance costs. Unregistered businesses are less expensive to comply with the Companies Act and are more free to operate without being bound by constant government oversight.

- Base and Equity Structure: Listed entities have a wide shareholder base of retail investors, institutional funds, foreign portfolio investors (FPIs) and high-net-worth individuals (HNIs). Their equity is well distributed which increases trading volumes and price stability. Unlisted companies are usually characterised by concentrated ownership of promoters, founders, early-stage investors and few external participants. This concentration is capable of impacting the process of governance and weakening the protection of minority shareholders.

- Access to Capital: Follow-on public offers (FPOs), rights issues, Qualified Institutional Placements (QIPs) and global depository receipts (GDRs) are ways that a public company can access equity capital, often raising large amounts of money in a short period. They are also exposed to a variety of markets in debt. Unlisted businesses have to raise capital through either private equity funds, or venture capital, or individually negotiated debt financings, which are slower and have strict terms imposed by investors.

- Governance Standards: SEBI requires that listed companies have a board composition requirement such as independent directors, audit and nomination committees and periodic evaluation of the board. These steps will be made to ensure that there is a fit between the management activities and the shareholder interests. In unlisted companies, such practices can be taken up voluntarily or on the basis of a private funding arrangement; but they are not usually subject to a standardized governance structure, but rather to the contractual guarantees negotiated between the company and investors.

- Immediate Liquidity: The ability to convert investments into cash at market price within days enhances portfolio flexibility.

- Regulatory Protections: Investor safeguards such as Insider Trading Regulations, Takeover Code, and LODR ensure fair treatment and dispute resolution mechanisms.

- Price Transparency: Real-time share pricing offers clarity on portfolio valuations, enabling precise performance tracking and timely decision making.

- Diverse Product Range: Exchanges list companies across sectors—large-cap blue-chip stalwarts, mid-caps with high growth potential, and thematic or sector-focused firms—allowing investors to build customized portfolios.

- Dividend and Corporate Actions: Public companies typically follow structured dividend policies and engage in rights issues, bonus shares, and buybacks that reward shareholders.

- Research and Analysis: Extensive analyst coverage, broker research, and financial media reporting enhance informed investment decisions.

- Early-Stage Upside: Investing in startups or emerging businesses before public listing can yield exponential returns if valuations rise significantly post-IPO or acquisition.

- Valuation Arbitrage: Private round pricing may not fully reflect future growth prospects, enabling investors to acquire equity at attractive discounts relative to eventual public market valuations.

- Strategic Influence: Venture capital and private equity investors often negotiate governance rights, including board seats, veto powers, and liquidation preferences, shaping company direction.

- Long-Term Partnership: Investors in unlisted companies engage in multi-year relationships, supporting business scale-up efforts, which can build deeper collaboration and alignment than public markets permit.

- Tax Incentives: Jurisdictions like India offer capital-gain tax exemptions for long-term holdings in unlisted startups under specified conditions, encouraging private investing.

Listed Company Risks

- Market Volatility: Share prices are prone to the extremes because of macroeconomic changes, industry cycles, political uncertainty, or the world news, and not necessarily because of an underlying company change.

- Regulatory Changes: The changes in the listing regulations, corporate governance codes or taxation policies can affect profitability and compliance costs.

- Information Overload: Retail investors may get confused with the plethora of analyst report information that produces noise and makes it difficult to decide.

- Dilution Risk: The problem of dilution can arise when the existing holdings are diluted by a follow-on, a public offering, or an ESOP allotment unless the dilution is accompanied by distribution of the same value.

- Illiquidity: The inability to sell positions as needed subjects investors to capital lock-in which makes portfolios less responsive and may force holdings to operate at the mercy of bad market time.

- Valuation Volatility: Sometimes valuations can be negotiated up or down by confident founders and result in inflated financing in later rounds.

- Governance issues: The lack of diluted control by promoters and the lack of independent supervision which is required may worsen the chances of related-party transactions, mismanagement, or minority oppression.

- Operational Uncertainty: Early-stage firms tend to have no tested business models, management experience or market penetration, which increases their failure rates.

- Regulatory Uncertainty: The introduction of new regulatory changes in the private market too fast may present compliance risks, particularly to international investors or complicated constructions.

The trade-off between liquidity and transparency and regulatory protection on the one hand, and early-stage growth potential, strategic control, and valuation arbitrage on the other are classic trade-offs between investing in listed and unlisted companies. Listed companies are easy to enter and exit, have ample information and a structured governance, which means they are appropriate when the investors would like to have a balanced risk-return profile and flexibility in their portfolio.

Although unlisted businesses are more illiquid and have greater information asymmetry, they are able to reward patient investors with disproportionate returns and greater engagement in disruptive business initiatives. The best investment plan can consist of a combination of investments in both types leveraging the stability of the public markets with the high-growth opportunities of the private markets, based on personal risk preferences, time periods, and target returns.