How to Purchase Pre-IPO Shares of Startups and Emerging Companies in India

Pre-IPO investing has become one of the most desirable investment strategies in emerging capital markets in India. Due to the unlisted shares offered by companies such as NSDL, OYO, and the National Stock Exchange, which have been making headlines, investors are starting to be more interested in getting access to high-growth opportunities before the masses can.

The entire process of acquiring pre-IPO shares can be used to unlock large wealth-creation capacity among informed investors.

What Are Pre-IPO Shares?

Pre-IPO shares are shares in companies that have not yet introduced their Initial Public Offering but are about to become publicly traded in the near future. The unlisted securities are sold in unpublicized markets, and this enables investors to have exposure to good business long before they are listed on stock markets such as NSE or BSE. Most pre-IPO companies usually have a well-established business model that is profitable, has differentiated products or services, and has an expansion strategy.

➢ In contrast to start-ups at early stages, where venture capital funding is the major source of finance, pre-IPO firms are operationally mature and are seeking access to the capital market to support their growth momentum.

➢ This is a good value proposition to different types of investors, including retail investors and institutional funds.

➢ The pre-IPO market includes domestic Indian firms intending on their offering via IPO or multinationals setting up subsidiary businesses in India.

➢ These corporations usually sell a restricted number of shares to a small group of investors, an exclusive investment type where a first-mover can receive a huge payoff when the IPO actually becomes a reality.

➢ The share prices are normally based on the current financial status of the company and growth projections and market positioning compared to other listed industry players.

Purchase Pre-IPO Shares in India

The procedure of purchasing pre-IPO shares has become more and more available and accessible in various legitimate mechanisms, each of which provides different benefits depending on the preferences and risk-taking capability of the investor. The knowledge of all these different paths enables investors to select the most appropriate path toward their investment goals and financial abilities.

➢ The internet platforms that focus on unlisted shares have transformed pre-IPO access by retail investors. Websites such as UnlistedSharesIndia.com have full marketplaces where investors review and buy and sell opportunities, as well as research. Such platforms maintain contacts with the company promoters, early investors, and employees who would prefer to sell part of their interests before the launch of the IPO.

➢ The general process of buying with the help of such sites starts with the creation of an account and full completion of the KYC process, which requires placing a PAN card, Aadhaar card, bank statements, and demat account data. After the verification, investors will be able to get a company profile, financials, and the existing prices. Placing an order involves entering the quantity wanted and agreeing to the current price in the market and making the payment in NEFT, RTGS, or UPI transfers.

➢ Alternative Investment Funds and Portfolio Management Services are complex investment tools, which raise funds on behalf of a number of investors to access pre-IPO opportunities. The maximum amount of unlisted securities that a Category II AIF can invest in is 25 per cent of its corpus, and professional management of pre-IPO portfolios is available through discretionary PMS providers. These systematic strategies have the advantage of diversification and professional management and have a large minimum investment, usually beginning between ₹50 lakhs in PMS and ₹1 crore in AIFs.

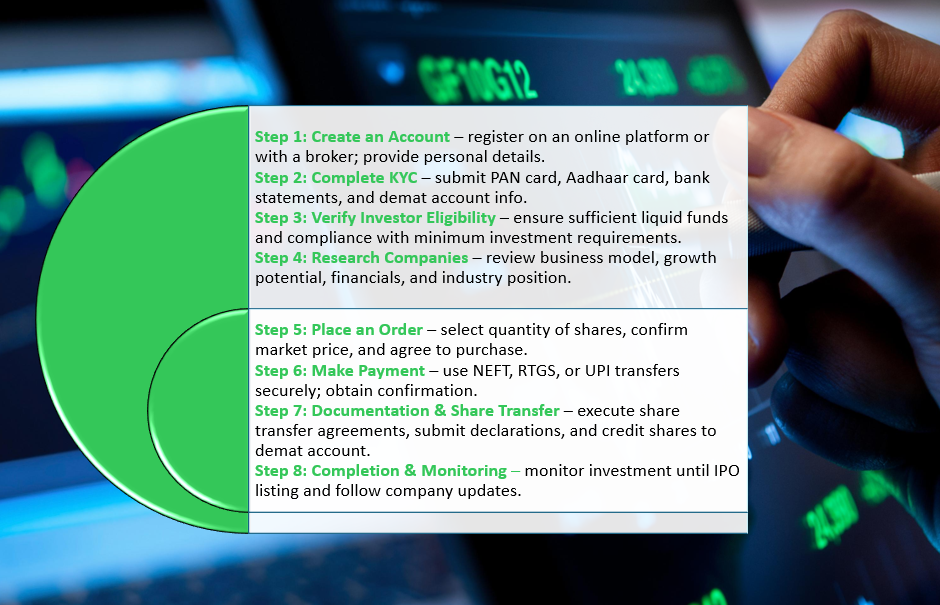

Pre-IPO Shares Application: How to Apply

Applications to pre-IPO shares involve a lot of consideration of regulatory compliance and documentation requirements to facilitate a smooth and easy transaction. Investors have to go through several processes in compliance with the guidelines and procedures of SEBI and platforms.

➢ The first step in pre-IPO is the eligibility assessment, which is the basis of the successful pre-IPO applications. The investors should have an active demat account with a registered depository, KYC, and adequate liquid cash to satisfy minimum investment requirements. Registration of platforms includes the application of identity verification documentation, bank accounts, and declarations of investment experience.

➢ Selection of the company requires in-depth studies of business basics, growth opportunities, positioning, and management standards. Before deciding on investments, investors must analyze financial statements, industry trends, regulatory environment, and possible listing timelines. Numerous websites offer in-depth research reports, peer reviews, and professional analysis in order to make informed decisions.

➢ When placing orders, it is important to specify the exact number of shares needed, verify the prevailing market prices, and determine the mode of payment. The majority of the platforms provide the duration of price validity of 24 hours to one week, so investors can organize the funding and preserve price stability.

➢ The execution of payments is usually done using secure banking methods, and confirmation has to be obtained before the initiation of share transfers. Completion of documentation refers to the execution of agreements of share transfer, giving requisite declarations, and giving the mandate of demat account crediting. It can take a matter of days, or weeks, depending on specific company procedures and regulatory approvals for a transaction, which can be involved in the whole process of application and receipt of shares.

How to Invest in Pre-IPO Companies Wisely

The aspects of pre-IPO investments that are concerned with safety go beyond simple due diligence to include relevant regulatory compliance, counterparty risk management, and portfolio allocation strategies. Thorough safety measures are applied in order to secure investment capital and to maximize the potential of returns.

➢ The platform verification is the initial barrier to fraudulent schemes and uncontrolled operators. Investors need to invest through SEBI-registered intermediaries, which are confirmed brokers and platforms that have clearly defined operating processes.

➢ Regulatory credentials, customer reviews, and platform track record are some of the measures that can be used to identify credible service providers.

➢ Due diligence initiatives ought to involve numerous aspects of company examination, such as financial performance analysis, analysis of the management team, analysis of the competitive environment, and analysis of regulatory risks. Before investing, the investors must demand audited financial reports, presentation of the business plan, and comprehensive disclosure documents.

➢ The process of analysis becomes stronger when independent claims are verified on the basis of third-party sources. Review of legal documentation will ascertain that the transfer of shares is done in a correct manner, the rights to ownership are upheld, and the dispute resolution mechanisms are present.

➢ Professional legal advice is especially helpful when investing in more significant investments or in a more complicated structure of transactions. Knowledge about lock-in periods, restrictions to transfers, and tax can be used to establish the right expectations regarding the liquidity of investments and the anticipated returns.

➢ When portfolio diversification is implemented to help manage risk, over-concentration on individual businesses or sectors is avoided. Financial advisors suggest that allocations made in pre-IPOs should not exceed 5-10% of total investment portfolios, that investments should be diversified to many companies, and sufficient liquid reserves should be held for other prospects or contingencies.

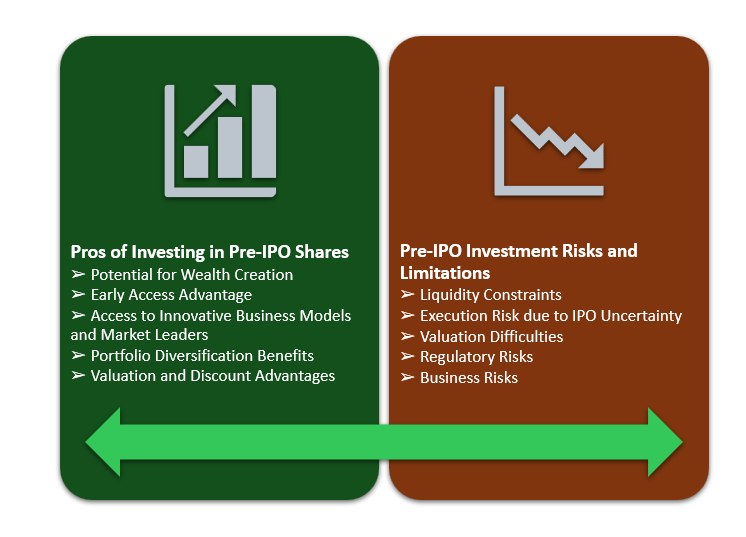

Pros of Investing in Pre-IPO Shares

Pre-IPO investment has unique benefits compared to traditional participation in the public market, and it establishes unique value propositions to investors ready to accept the risks and restrictions involved.

➢ The potential of wealth creation can be seen in the historical examples where Anand Rathi Wealth Services, listed in December 2021, climbed from pre-IPO levels of about ₹175 to around ₹2,950 today, and Bikaji Foods, listed in November 2022, rose from about ₹300 to roughly ₹776.

➢ The benefits of early access enable investors to invest in high-growth companies before institutional competition and market forces in the public market affect pricing. This insider privilege allows investors to enjoy company growth at important stages of development when the value creation is strong.

➢ Having access to new business models, disruptive technologies, and market leader companies before their recognition offers competitive benefits.

➢ The benefits of portfolio diversification are realized through the low correlation of pre-IPO investments to movements of the public market, which ensures stability during volatile market times. These investments tend to have a bearing that is independent of the larger economic cycles, providing portfolio strength and lessening the overall investment risk by means of asset class diversification.

➢ Pre-IPO pricing is generally favored by valuation benefits, and shares are frequently sold at a discount to the equivalent public company or estimated IPO pricing. This valuation gap brings about value potential in the short term and in addition offers downside protection in case market conditions go down. Mispriced opportunities often turn out to be found by professional investors where intrinsic value is higher than current market prices.

Pre-IPO Investment Risks and Limitations

Pre-IPO investing is fraught with risks that the investor must be aware of and take upon themselves, risking their substantial capital on such opportunities. The realization of possible challenges will allow making a more appropriate decision regarding investing and proper risk management strategies.

➢ The greatest weakness of pre-IPO investments is liquidity constraints because these shares are not very easy to sell until the IPO listing takes place. In contrast to the low-liquidity securities traded publicly with continuous trading rights, pre-IPO shares can have holding periods that span over several years before they become liquid. SEBI requires further lock-in of 6 months on mainboard IPOs and 1 year on SME IPOs post-listing and further limits investor flexibility.

➢ Pre-IPO investors face significant execution risk because of IPO uncertainty since firms can postpone, alter, or abandon their plans to go public depending on market conditions, regulatory problems, or internal strategic shifts. Fluctuations in the market, economic recession, or industry-related issues can always delay IPOs without exit plans, so the investors are not even sure how to get themselves out.

➢ The difficulty of valuation is due to less financial reporting in private firms, and therefore precise company evaluation is hard as opposed to the public market counterparts. Asymmetry of information between the company management and the external investors may lead to overvaluation of the company or poor risk evaluation. This is because without continuous market pricing mechanisms, it makes it difficult to monitor continuous investments and make decisions.

➢ Regulatory risks include the transformation of SEBI guidelines, taxation, and compliance regulations that have the potential of affecting investment returns or holding processes. Recent regulatory changes such as the exploration of regulated pre-IPO trading platforms by SEBI are evidence of the changing characteristics of this area of investment and future constraints.

➢ The pre-IPO companies are still exposed to business risk though the companies are mature in their operations because they are exposed to competitive forces, market disruption, and implementation difficulties which may damage growth opportunities or financial performance before the completion of the IPO.

Conclusion

Pre-IPO investment in India offers attractive possibilities to investors who wish to be exposed to a high-growth company prior to its public availability. These investments have been made more accessible due to the combination of digital platforms, the evolution of regulations, and the growing involvement of companies, but they retain their exclusive nature and investment returns potential.

To be successful in pre-IPO investing, one must have a solid knowledge of the application procedures, safety, and risk prevention measures. When investors approach such opportunities with due diligence, realistic expectations, and a good sense of portfolio diversification, the early entry into the most promising companies in India can lead to a lot of gain. The regulatory environment is constantly changing, and the latest proposals of the SEBI to introduce regulated pre-IPO trading platforms may revolutionize this area of investment.

These developments indicate that the pre-IPO markets will remain supported at the institutional level and also improve investor protection and transparency. In the future, pre-IPO investing will probably continue to be a significant aspect of advanced investment portfolios with a distinct ability to access wealth creation opportunities not available on traditional participation in the public markets. Those investors who figure out the intricacies of this space and continue to pursue disciplined risk management strategies will position themselves to take advantage of the current economic growth and capital market development in India.