How to Invest in Unlisted Companies in India: Benefits, Risks, and Tax Implications

Investment options in India have taken a turnaround, with investors shifting focus from listed companies to unlisted ones, finding opportunities that are beyond the stock exchanges. From companies taking their first steps toward running to those readying for public debuts, these private businesses, including start-ups, are an alternative investment opportunity that has become a popular choice for both everyday and bigger-pocketed investors. India's unlisted share market has been expanding, as more than 1,300 unlisted firms have reported profits of over Rs 1 billion during FY2024. This space gives investors the opportunity to be part of early-stage growth stories, first access to investment opportunities, and may even fetch listing gains when companies eventually list their shares.

What Are Unlisted Companies in India?

➢ Unlisted companies are privately held companies whose shares are not there for trading on stock exchanges, including the NSE and BSE. These span various categories such as BFSI, technology, media & education, healthcare, consumer, etc., and are supported by venture capital, private equity firms, or high-net-worth individuals.

[Explore various industries here]

Unlisted companies, in contrast, are not subject to these disclosure requirements or regulatory scrutiny, which allows them greater flexibility in the conduct of their operations but also results in information disparities for investors.

➢ The India unlisted universe has several sets of companies segregated across different growth stages. Some are well-established businesses that have consciously stayed private despite being more than capable of going public, and others are rising start-ups looking to raise capital for growth.

➢ These companies create shares through various mechanisms, including Employee Stock Ownership Plans, where employees receive equity compensation; private placements, where companies raise funds from selected investors; and debt-to-equity conversions.

How to Invest in Unlisted Companies

➢ These are types of companies that generate shares through different forms, such as employee stock ownership plans, where the employees are given stocks; private placements, where the companies raise funds from chosen investors; and debt-to-equity conversions.

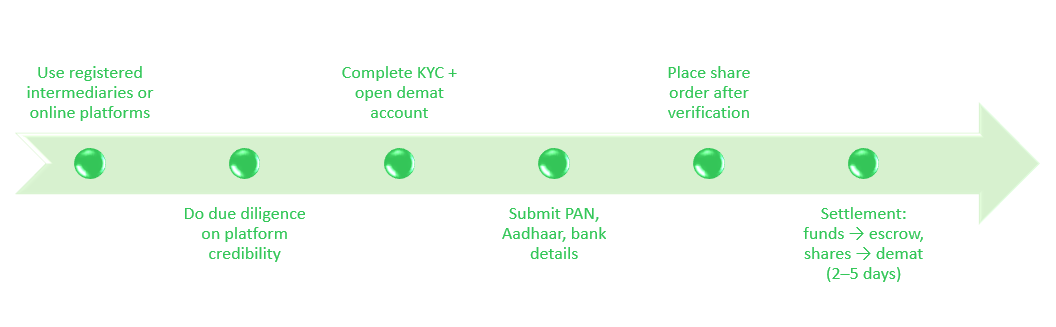

➢ If you want to invest in unlisted companies, then you have to go through special gateways, as you cannot simply buy unlisted shares from the stock exchanges. There are two main channels in this regard: registered intermediaries and online platforms (where buyer and seller meet to close their deal) of unlisted stock, such as UnlistedShareIndia.com

➢ Since all the services, as a rule, cannot be obtained with only one single platform/mediator, the investment process should start with identifying a proper platform/mediator after a rigorous due diligence process regarding the platform/mediator's historical performance, regulatory conformity, customer support, and so on. It is important to submit the required documents, including the PAN card, Aadhaar card, and bank information, and do a KYC (Know Your Customer) verification and have the demat account for clearing shares. After those conditions are satisfied, users may have access to listing quotes and company profiles and place an order for shares they are interested in.

➢ There are alternate funding routes such as direct investments in start-ups during funding rounds besides investment through Portfolio Management Services (PMS) companies focusing on private equity, where the minimum ticket size could be as high as 50 lakh, or investments in AIFs investing in unlisted securities. For employees of private companies, there is another path: stock options that enable workers to own a stake in the company at a price the company sets in advance. Recent regulations have also provided for co-investment through AIFs that allow accredited investors to co-invest with institutional funds in unlisted company investments. The transaction is settled by transfer of funds to the escrow account of intermediaries and transfer of shares in the off-market from the demat account (of the selling broker) to the demat account (of the investor) with either the NSDL or CDSL depository. This usually takes between 2 and 5 business days, depending on the platform and transaction complexity.

Benefits of Investing in Unlisted Companies

➢ Private companies provide investors with early access to fast-growing companies before they go public via an IPO. This advanced-stage pre-public investment opportunity also has the potential for significant upside if we look at cases such as Tata Technologies, which saw its share price rise from Rs 172.5 post bonus in 2021 to close at Rs 1,400 on listing day, providing early investors with returns of about 711%. The opportunity here is that you can invest at a super low valuation compared to any other previous investors; they've invested in these companies when they have solid fundamentals and future revenues.

➢ Portfolio diversification: Unlisted investments offer exposure to sectors, business models, and growth stages that are difficult to access through public markets. Investors can tap into emerging industries such as fintech, edtech, and renewable energy through firms that do not yet meet listing criteria but have potential for future success. The unlisted market also gives access to mature businesses (not listed) that prefer to stay private and still deliver predictable cash flows and profits.

➢ Reduced market volatility: Over-the-counter (OTC) shares tend to be less volatile because they are not exposed to day-to-day volatility caused by market sentiment, news flow, and trading. This lack of volatility enables investors to take a long-term view without being affected by market fluctuations, which plague listed securities. Although it may be challenging to trade, the lack of liquidity can protect you from trading on gut feel or fads of the market.

➢ The universe of investment is enormous, comprising over 20,000 unlisted companies in India, across sectors and stages of existence. With that diversity come many opportunities for investors to find companies in line with their investment thesis, their appetite for risk, their expectations regarding return, and their preferences for homegrown organic businesses versus acquisitions. Most of these companies eventually become IPOs, which gives early investors the opportunity to exit at listing gains.

Risks of Investing in Unlisted Companies

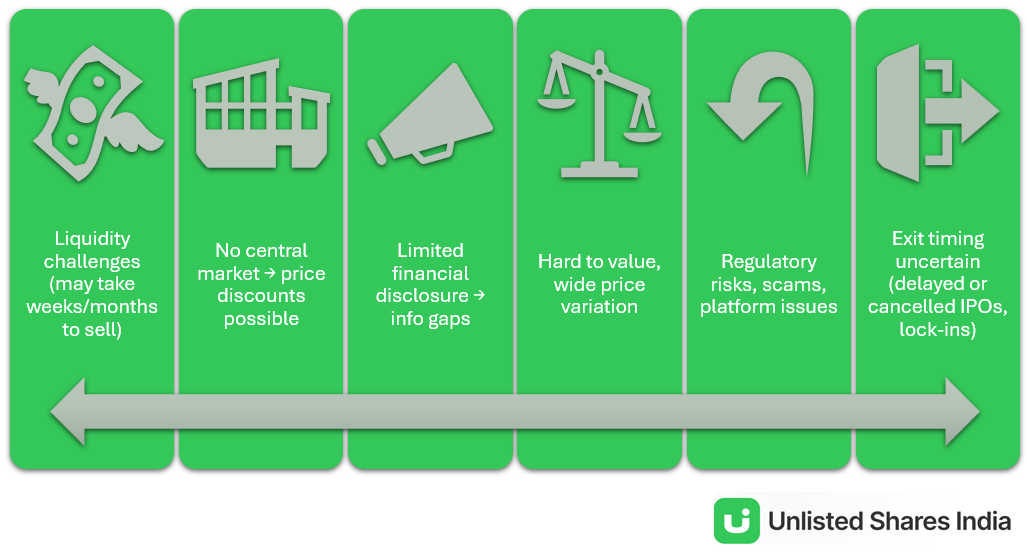

1. Liquidity: If the shares have no liquidity event (i.e., you cannot trade instantly with others on “the market” like you can with listed shares), they require intermediaries to connect willing buyers with willing sellers. That process could happen within a few days, weeks, or months.

2. Lack of Central Market: As there is no centralized market, investors may have to sell at a discount (to perceived fair value) compared to what buyers want to pay. Investors tend to have difficulty buying significant amounts of shares that trade thinly, especially in bear markets.

3. Information Asymmetry: Another significant risk is information asymmetry, as private companies are not required to publish quarterly financials or disclosures as stringent as those demanded by listed companies. Investors are left to rely on annual reports that can be up to 15 months old, limited financial data, and management presentations that do not always offer a full view of the operation. This opaqueness makes it very hard to perfectly judge the prospects, competitive standing, and quality of leadership within the company.

4. Valuation Difficulties: Valuation difficulties stem from a lack of continuous price discovery as occurs in the public markets. Pricing for unlisted shares is generally a private affair between buyers and sellers, and prices can vary widely depending on different platforms and time periods. With no regulated valuation processes or third-party price verification, investors could end up paying too much for their shares and/or find it challenging to establish fair value when exiting.

5. Regulatory Risks: Risks have increased as SEBI has cautioned against trading on unauthorized platforms and also stated that certain electronic platforms that enable trading of unlisted shares could be a violation of securities laws. The regulation of the trading of unlisted shares is still developing, with future compliance obligations and changes to the trading landscape still to crystallize. Further, scams like those related to NSE shares, where investors were duped of Rs 26.5 crore on the false promise of share delivery, highlight the relevance of due diligence in choosing the platform.

6. Exit timing ambiguity exacerbates these risks, as the time to exit (IPO) may be postponed or abandoned by firms, leaving investors without well-defined schedules for liquidity events. And even when they do IPO, companies’ early investors are obligated to hold their shares for a period of time after the public offering, often six months, during which they can’t sell on stock exchanges and might miss the right timing “window.”

Tax Implications of Investing in Unlisted Companies

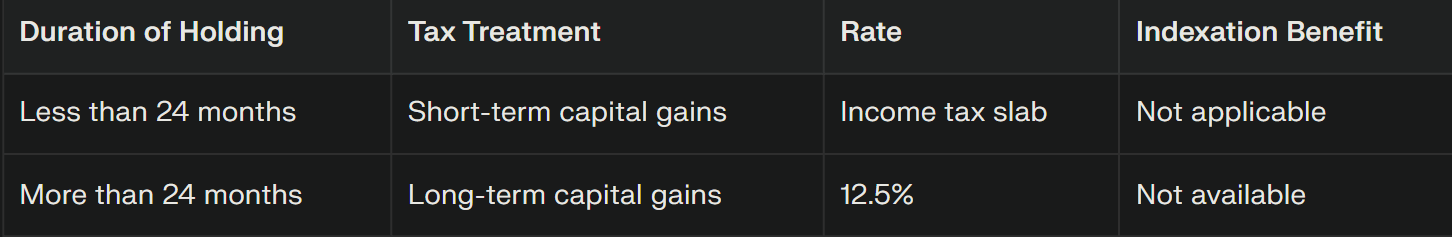

➢ Unlisted shares are taxed similarly to listed ones, but with different holding periods and rates. For unlisted shares, gains are considered long-term only if held for more than 24 months, compared to 12 months for listed shares. This longer period reflects the illiquidity of unlisted investments and encourages long-term holding.

Short-term capital gains (for shares held less than 24 months) are taxed at the investor’s income tax slab rate, ranging from 5% to 30% plus cess.

Long-term capital gains on unlisted shares held beyond 24 months are taxed at 12.5% without indexation, following recent changes that removed indexation benefits.

➢ Acquisition cost matters in cases of gifted shares or corporate actions like bonus issues or stock splits. Gifts of unlisted shares from relatives are tax-exempt at transfer, but when sold, capital gains are calculated based on the original owner’s purchase price, which may lead to higher taxable gains if the original buy price was low.

➢ Stamp duty also applies. Since July 31, 2020, unlisted share transfers attract 0.015% stamp duty (down from 0.25%). Allotments of unlisted shares are charged 0.005% (down from 0.1%). These costs are usually borne by buyers, though some platforms include them in quoted prices.

➢ Parts of Schedule 112A may need to be filled depending on the ITR form used (ITR-2 or ITR-3). Gains or losses from sales must be entered in Schedule CG (section B9 for long-term, section A5 for short-term). Failing to report correctly can result in penalties and interest, so accurate record-keeping is essential.

Key Factors to Consider Before Investing

➢ It is here that a company's fundamental analysis becomes a critical platform for unlisted investments, as only little information is available and there is a lack of net-based price discovery. What to look for are trends in the growth of revenues, the margins of profitability, debt levels, free cash generation, and competitive advantages within an industry. Knowing the company’s business model, quality of management, corporate governance policies, and roadmap gives insights into if the company is, ideally, positioned for success and creation of long-term value.

➢ When deciding where to trade, keep in mind factors like the credibility of the middleman trader, the transaction history, customer service, and the fee schedule on the platform you’re using. Investors would also be wise to make sure that the selected platform has sufficient escrow capabilities, does not levy hidden charges, and has well-defined grievance redressal.

➢ The risk and illiquidity associated with unlisted investments should be recognized in investment size and portfolio allocation decisions. Financial planners generally suggest that investors allocate no more than 5-10% of their total portfolio to unlisted shares, making it possible for the funds to be tied up for a long time without having a significant impact on overall goals. Diversity within unlisted investments based on sectors, stages of companies, and themes of investment can minimize concentration risk.

➢ Exit planning is a must, not least because there is no clear schedule for liquidity events. Understanding possible exit strategies for your investments, ranging from an IPO and acquisition opportunities, which are most obvious, to management buybacks as well as secondary markets is essential. A realistic time frame to own a company, usually 3 to 5 years or more, helps manage expectations and discourages selling too soon when losses are incurred.

➢ Scrutiny of management, promoters, quality of investors, and company track record gives valuable clues to the quality of the investment. The company's growth funding plans, timeline until IPO, and strategic direction can be intriguing criteria to gauge alignment with investment ideals. This knowledge of the lock-in period, voting rights, dividend policy, and corporate actions helps the investor to make rational decisions at all stages of investment.

Conclusion

It’s that investing in unlisted companies is becoming an attractive proposition for those looking for diversification and early exposure to growth companies before they list on the market. India’s unlisted share market looks promising, with a string of unicorns and value-creation stories underpinning the early-stage participation. Nonetheless, risks of illiquidity, information asymmetry, and regulatory uncertainty should be kept in view.

The wider regulatory landscape with new co-investment structures and increased scrutiny from SEBI represents a greater awareness of the role of the unlisted market in India’s financial system. Growing tech-enabled access and lower minimum investments are bringing in more retail investors, contributing to the democratization of private market investing.