How to Buy NSE Shares in India: A Step-by-Step Guide

What Are NSE Shares?

Purchasing the shares of the National Stock Exchange of India Limited (NSE) prior to its IPO on the stock exchange has been an attractive investment for investors who prefer to own a share in the major trading platform in the country. The equity of NSE is not traded on the BSE or even on NSE, as is the case with other stocks. It is a privately traded company in what’s referred to as the unlisted or pre-IPO market. This is a clear explanation of how this market is run, the real purpose of brokers, and how you go about it as a buyer without becoming lost in the legal language. [Compare NSE vs BSE: FY25 Performance]

With the latest development, NSE’s CEO Ashishkumar Chauhan recently said the long-awaited IPO could arrive within the next 8-9 months, a move that would finally let public investors own a stake in the country’s largest exchange.

What “Unlisted” Really Means?NSE is a private company. Its stock is not listed on the regular exchange but has an ISIN (INE721I01024). Ownership may be transferred off-market only if it is approved by the NSE board. The most important thing is that you may get quotes on the internet, but each transfer requires company approval. That guards the cap table against undesirable investors and records ownership details.

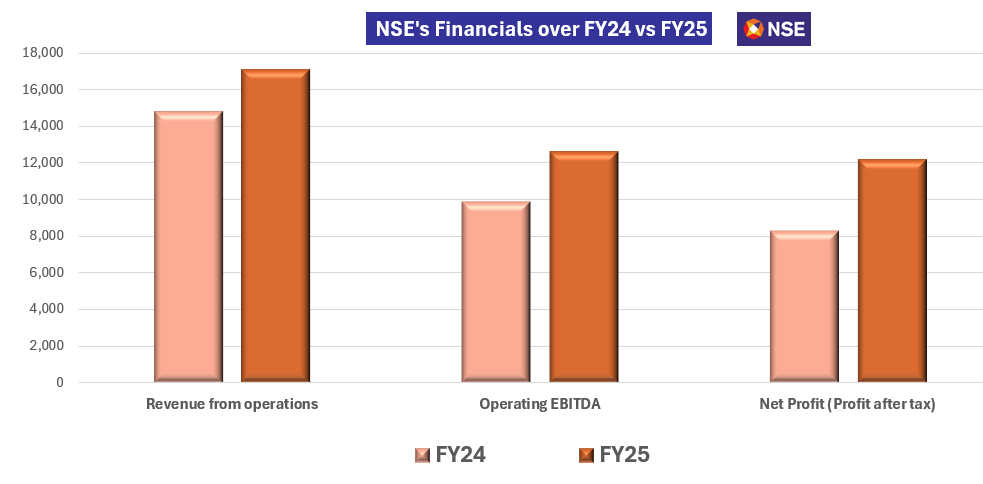

Financial strengthFor FY25 specifically, the exchange reported revenue of about ₹19,177 crore and a net profit near ₹12,188 crore, highlighting a net margin of roughly 64% and an expense-to-revenue ratio close to 34%. Those figures represent various sources of revenue: transaction fees on equities and derivatives, data service to institutions, listing and technology services, and treasury revenue on cash balance.

Requirements Before You Buy NSE Shares in India

➢ The Way the Market Works in Reality: Most individuals believe that brokers have in their possession ready stocks of NSE shares and can sell to you immediately. In fact, they are more like matchmakers.

➢ Seller networkBrokers have contacts among current NSE stockholders, former employees, institutions, or early investors, who are willing to sell some of their stakes. Indicative prices are established by the shareholders.

➢ No exchange order book, indicative quotesThe live prices that you are viewing on the websites are negotiated amounts that depend on the offers and recent trades. They assist buyers and sellers to meet halfway, but such agreements are never binding until a deal is reached.

➢ Escrow and complianceAt the point of an agreed price, you deposit money in a controlled escrow account. The shares remain in the hands of the original owner until they are transferred by the NSE board. The seller only instructs the depository to transfer shares to your demat after such approval.

This design implies that the broker does not have to hoard stocks. They arrange the deal and take your payment safely as the company does its checks.

Step-by-Step Process to Buy Shares in NSE India

The view of the investor is given below. The broker or the dedicated platform that you have decided to go through will do all the complicated paperwork, including the annexures, powers of attorney, and notarisation.

➢ Select a Trustworthy Site or Merchant: Start with a reputable unlisted-shares broker. These may be well-established boutique dealers and online portals that focus on pre-IPO equity. Examine their history: number of years in the business, SEBI registration where applicable, reference list of their clients, and successful transactions in NSE. [Get the best prices of Unlisted Shares]

➢ Discuss Price and Quantity: You will get an updated quote and size of lot. The usual market lot size is 250 shares, although this may fluctuate depending on what a selling shareholder is offering.

➢ Share Your Basic Details: The broker asks you to give your demat account number, PAN, and simple KYC papers. That is primarily to establish identity and connect your demat account so the final transfer is possible. It ensures that your depository participant is able to process off-market transfers.

➢ Place Funds in Escrow: You move a negotiated advance—normally the full amount—to a neutral escrow account administered by a regulated trustee or by the banking partner of the platform. This ensures both parties: the seller is assured that there is money at hand and you are assured that it cannot be released until the transfer has been approved by the exchange.

➢ Broker Processes Company Filings: The broker now assists the selling shareholder to prepare and file the application with NSE. Here all the legal annexures, declarations, and notarised forms are included, but you do not need to write them yourself. Quality brokers will give you an update as they take care of all signatures and stamping.

➢ Final TransferOnce it is accepted, the escrow disburses your cash to the seller. The depository participant of the seller issues a Delivery Instruction Slip, and the shares are credited to your demat account. The depository provides you with an SMS and email confirmation.

➢ Charges and Fees Involved in NSE Share Trading: In addition to the negotiated share price, plan to pay:

- Brokerage/platform fee which can be 1-2 percent of the value of the deal, including escrow and facilitation.

- Escrow and bank fees which normally are a couple of hundred rupees.

- Depository participant fees – minor fees on off-market transfers.

Tips for Beginners Investing in NSE Shares

If you are planning to buy unlisted NSE shares for the first time, a careful approach and awareness of recent financial data can help you make better decisions.

1. Begin with thorough due diligence: Check the broker’s SEBI registration and reputation. Ask for proof of past transactions in NSE shares and verify that the seller can provide valid holding statements. Review NSE’s annual reports to understand its performance and governance.

2. Plan for a long investment horizon: NSE remains unlisted and its IPO date is not fixed. Treat this as a private market investment that may require several years of holding before any liquidity event.

3. Know the lot size and entry cost: NSE unlisted shares usually trade in lots, often starting around 250 shares. At recent market prices of roughly [Check Current Market Price of NSE’S Unlisted Shares], your initial investment might begin around ₹5 lakhs.

4. Use secure payment methods: Work only through an escrow service or a broker’s regulated banking partner so that funds are released to the seller only after the shares are credited to your demat account.

5. Keep detailed records: Save all agreements, payment proofs, and the final depository confirmation. You will receive SMS and email alerts when the shares are officially credited, which act as your proof of ownership.

6. Stay updated on developments and financials: Track NSE’s quarterly results and key announcements such as regulatory changes, option expiry and trading volume trends, or IPO-related news. Keeping an eye on such data helps you assess whether your investment thesis remains sound.

Conclusion

It is attractive to have a share in the biggest stock exchange in India, but it is not as simple as just clicking and buying a listed share. The unlisted market operates on the basis of private negotiation and company approval.

The key steps that you should undertake are finding a reliable agent, negotiating the price at which you are buying, and waiting as the exchange closes the deal. The broker does all the hard work, paperwork, arranging with the seller, and leading the deal through the NSE board. Unlisted shares of NSE can give investors who are comfortable with that process and have a multi-year horizon a rare chance to take part in the expansion of the financial infrastructure in India.