Nayara Energy, a prominent player in India’s private oil refining and retail space, stands at the edge of a major transformation. Recent reports from early 2025 have highlighted that Rosneft, the Russian oil giant, is contemplating the sale of its 49.13% stake in Nayara Energy.

This move comes as a result of the ongoing challenges Rosneft faces in repatriating profits due to Western sanctions, signaling its intent to exit. Far from being a cause for concern, this potential sale could herald exciting opportunities, particularly for Indian corporations interested in stepping in. If Indian investors take charge, Nayara’s established foundation and ambitious expansion plans could see rapid growth and increased market value.

Nayara Energy and Rosneft’s Stake

The formation of Nayara Energy traces back to 2017 when Rosneft and its consortium acquired Essar Oil in a landmark $12.9 billion deal, marking the largest foreign investment in India’s refining sector. As part of this deal, Rosneft secured a 49.13% stake, while the remaining shares were divided between Trafigura and UCP Investment, each holding 24.5%, with other minority shareholders making up the rest.

Today, Nayara operates the Vadinar refinery in Gujarat, which boasts a massive capacity of 20 million tonnes per year (400,000 barrels per day). It also manages a network of over 6,500 retail fuel stations across the country, making it the largest private fuel retailer in India. These assets – the refinery and the retail network – position Nayara as a crucial player in India’s energy sector.

The Driving Force Behind Rosneft’s Potential Exit

The decision by Rosneft to potentially sell its stake in Nayara is primarily driven by geopolitical factors. Since 2014, Russia has faced sanctions that restrict the movement of its capital, making it difficult for Rosneft to repatriate profits from its Indian operations. As a result, Rosneft’s financial returns from its stake in Nayara have been significantly affected. By divesting, Rosneft could free up capital and reduce the operational complexity arising from these sanctions. While this represents a strategic decision for Rosneft, it opens up a range of possibilities for Nayara’s growth under new ownership.

Indian Corporates Show Interest in Acquiring Nayara’s Stake

Several major Indian conglomerates have shown interest in acquiring Rosneft’s stake in Nayara, underscoring the strategic value of the asset. Some of the prominent names reportedly in discussions include:

- Reliance Industries: As India’s largest private refiner, Reliance is continuously looking to expand its downstream operations and could leverage Nayara’s capabilities to strengthen its position in the market.

- Adani Group: With its rapid growth in the energy and infrastructure sectors, Adani Group has emerged as a strong contender in the bidding process.

- JSW Group: A diversified conglomerate, JSW has shown interest in expanding its presence in the energy sector, with Nayara presenting a key opportunity for growth.

The fact that global players like Saudi Aramco also showed initial interest in Nayara highlights the asset’s attractiveness. While some companies have raised concerns about the investment’s returns and capital requirements, the overall interest in Nayara remains strong. This signals that a transformative deal could be on the horizon.

Nayara’s Strategic Position in India’s Energy Market

Nayara’s integrated business model makes it a unique and highly strategic player in the energy sector. Apart from refining, Nayara is making significant strides in petrochemicals, a sector expected to witness explosive growth in the coming years. The company already operates a 450 KTPA polypropylene plant at its Vadinar site and has announced a major $8 billion expansion project to develop a new ethane cracker, which will produce 1.5 million tonnes of ethylene annually. These moves are expected to strengthen India’s domestic petrochemical capacity and serve the growing demand in the region.

In addition to its refining and petrochemical ambitions, Nayara is rapidly expanding its retail fuel network. The company plans to add about 400 new petrol stations in 2025, further extending its footprint across key markets in India. This ambitious retail expansion complements Nayara’s commitment to local entrepreneurship and the “Make in India” vision, boosting local job creation and economic growth.

What a Change in Ownership Could Mean for Nayara

A transition to Indian ownership could bring significant benefits for Nayara. Local investors like Reliance or Adani would not only have the financial strength to support Nayara’s expansion but also a deep understanding of the domestic market, enabling them to integrate and streamline operations. This could lead to improved efficiency across oil procurement, refining, and marketing, driving down costs and enhancing profitability.

With the sanctions removed, Nayara would have greater flexibility to pursue its growth plans, including expanding its petrochemical capacity, investing in cleaner technologies, and increasing its renewable energy portfolio. Additionally, Indian ownership would bring enhanced regulatory stability and a closer alignment with national energy priorities, making it easier for Nayara to access financing and global supply chains.

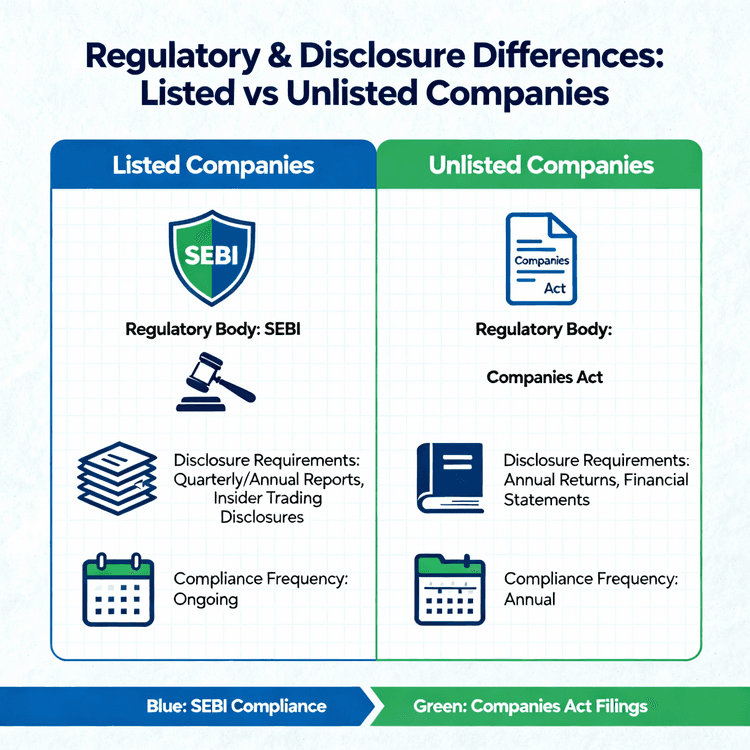

Implications for Unlisted Shareholders

One of the most immediate effects of Rosneft’s potential exit and the ongoing acquisition discussions is the impact on Nayara’s unlisted shares. As Indian corporates express interest in acquiring a stake, the valuation of Nayara’s shares is likely to increase. The ongoing discussions and potential deal have already generated a positive sentiment among Nayara’s investors, with expectations of a re-rating of unlisted share prices.

Unlisted shareholders are likely to benefit as the credibility of Nayara strengthens with new ownership, potentially leading to greater liquidity and an enhanced valuation of their shares. The speculation surrounding the sale is likely to increase investor interest in Nayara’s unlisted shares, especially as the company continues its ambitious expansion plans. As these developments unfold, existing investors may see a significant return on their investments, further boosting confidence in Nayara’s long-term prospects.

The potential sale of Rosneft’s stake in Nayara Energy presents an exciting opportunity for growth and value creation. With its strong refining and retail capabilities, along with ambitious plans in petrochemicals, Nayara is well-positioned to continue expanding. A shift to Indian ownership could unlock new resources and partnerships, accelerating the company’s growth while sidestepping geopolitical hurdles.

For unlisted shareholders, the potential sale represents an opportunity for increased value, as the company’s credibility and growth trajectory gain new momentum. In all, Nayara’s future looks bright, with the promise of stronger domestic control, improved market conditions, and substantial returns for investors.