So, what does it really mean to invest in pre-IPO shares? In simple terms, you’re buying a piece of a private company before it makes its big debut on a public stock exchange like the NSE or BSE. This isn't something you can do through your regular brokerage account. Instead, access usually comes through specialised investment platforms, private equity funds, or by connecting directly with company insiders – think employees or early backers looking to cash out some of their stake. It’s your chance to get in on the action before the rest of the market does.

Why Is Everyone Talking About Pre-IPO Investing?

The allure of backing a company before it goes public is undeniable. For a long time, this was a world reserved for venture capitalists and big-shot institutional investors. While the doors have started to open for others, don't be mistaken – it's still a high-stakes arena.

Let's get past the jargon. The real magic of learning how to invest in pre-IPO shares is the opportunity to be part of a company’s most dramatic growth spurt. By the time a company lists publicly, much of that explosive initial growth might already be in the rearview mirror.

Think about the household names in tech we use every day. Imagine having had the chance to invest when they were still late-stage, private startups. The jump in valuation from that final private round to the IPO price alone can create incredible wealth, a gain that public market investors completely miss out on. This is precisely what pulls so many savvy investors into this space.

The Hunt for Superior Returns

Let's be honest, the main reason anyone ventures into the pre-IPO market is the potential for significant financial gain. While public markets provide the comfort of liquidity and relative stability, private markets offer a shot at truly exceptional returns.

Here’s a closer look at why the growth potential is so much higher:

- Valuation Arbitrage: It’s common for companies to go public at a far higher valuation than their last private funding round. As an early investor, you stand to benefit directly from this difference.

- Investing in the Future: You’re often backing companies at the absolute cutting edge of their fields, whether it’s AI, biotechnology, or green energy, long before the mainstream market catches on.

- An Exclusive Edge: Simply gaining access to these private deals, which are off-limits to the general public, can give your investment portfolio a powerful and strategic advantage.

Of course, this potential for high reward doesn't come without its own unique risks. Buying pre-IPO shares isn't like trading on a stock exchange. It demands a great deal of patience and a solid tolerance for uncertainty.

This isn't a strategy for quick profits; it's a long-term game. You are placing a bet on the company’s vision, the strength of its leadership, and its ability to deliver over several years. For a more thorough breakdown of the basics, feel free to read our guide on what pre-IPO investing entails.

To succeed here, you need to shift your mindset from a public market trader who watches daily price ticks to that of a private equity partner who invests with patience and conviction. It’s about becoming part of the company's story, not just a temporary owner of its stock. In the sections that follow, we'll give you the tools and insights needed to navigate this exciting but demanding landscape.

Getting to Grips With the Pre-IPO Market

Dipping your toes into the world of pre-IPO investing can feel a bit like stepping behind the velvet rope at an exclusive club. It doesn't operate like the public stock market you might be used to. The biggest difference is how you actually get your hands on the shares. You won't just be logging into your usual brokerage account; you'll be navigating a more private, relationship-driven world with its own set of rules.

To get started, you need to understand the two main ways shares become available: primary issuance and secondary transactions.

Primary issuance is the big one—it's when a company creates brand-new shares to sell and raise money. These deals are usually snapped up by venture capital firms and other large institutions. For most individual investors, the real opportunity lies in secondary transactions. This is where existing shareholders, like company employees, executives, or early angel investors, decide to sell some of their personal holdings.

These secondary sales are what make the pre-IPO market tick. Maybe an early employee wants to cash out some shares to buy a house, or an early-stage fund needs to sell its stake to return profits to its own investors. Whatever the reason, this is the market that specialised platforms tap into, connecting sellers with buyers like you.

Who's Who in the Private Market Zoo

To play the game, you need to know the players. The pre-IPO ecosystem is a network of different groups, and each plays a distinct role. Getting a handle on who does what will help you spot the right opportunities and make sense of any deal that comes your way.

Here’s a quick rundown of the main participants you'll encounter:

- Venture Capital (VC) and Private Equity (PE) Firms: Think of these as the institutional heavyweights. They pour huge amounts of money directly into companies, often getting preferential terms. You probably won't be investing alongside them, but their involvement is a huge vote of confidence in a company's future.

- Specialised Pre-IPO Funds: These funds are a popular entry point for many. They pool money from accredited investors to build a portfolio of shares in various late-stage private companies. It’s a great way to get diversified exposure without having to source individual deals yourself.

- Secondary Market Platforms: These are the online marketplaces that bring buyers and sellers together. They act as the go-between, creating a structured and more secure environment for trading private shares. You can browse a range of available pre-IPO shares on platforms like ours to see how it works.

- Company Employees and Early Investors: These are the people on the other side of the trade—the original sellers. Their reasons for selling can be anything from personal financial planning to simply wanting to diversify their own portfolio. They create the supply that keeps the secondary market moving.

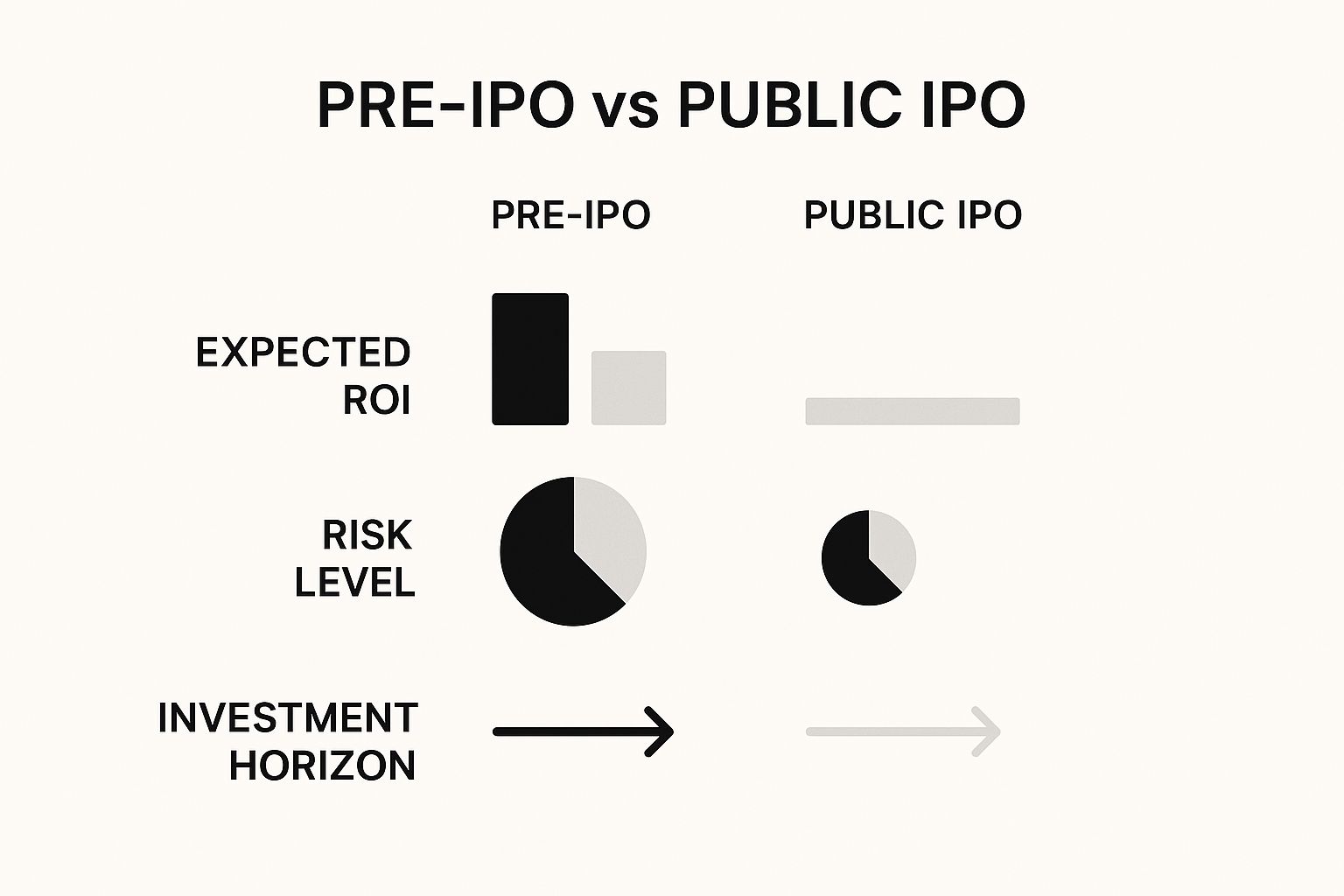

As you can see, the aim of pre-IPO investing is to chase higher returns over a longer period, but that ambition comes hand-in-hand with significantly higher risk compared to jumping in during a public IPO.

A Closer Look at the Indian Market

The Indian market has become a real hotspot for this kind of activity, making it an exciting place for pre-IPO investors. The growing appetite for new listings tells us the market is healthy and investors are confident. Just look at the numbers: in the 2025 fiscal year, India saw 80 mainboard IPOs raise a massive INR 1,630 billion. That’s a huge leap from the INR 619 billion raised the year before. You can dig into the specifics in the KPMG report on Indian IPOs in FY25.

The demand is clearly there. We've seen incredible oversubscription rates, with retail investors bidding for 35x the available shares and Qualified Institutional Buyers (QIBs) hitting an average of 102x. This shows a deep well of domestic capital just waiting for quality companies to invest in—a very encouraging sign for anyone looking to get into pre-IPO investing in India.

How to Find and Access Pre-IPO Deals

Unlike flicking through the public stock market on your favourite app, finding genuine pre-IPO opportunities takes a bit more legwork. These deals aren't splashed across the front page of financial newspapers. They live in a much quieter, network-driven world, and knowing where to look is half the battle.

The good news? What was once the exclusive playground of venture capitalists and massive institutions has opened up considerably. Today, several solid pathways can lead you straight to promising late-stage private companies. The trick is to understand how each one works and figure out which fits your own investment style and budget.

Exploring Specialised Online Platforms

For most investors dipping their toes into this space, the easiest entry point is through specialised online platforms that act as secondary marketplaces. Think of them as organised exchanges for private company shares. They essentially connect existing shareholders—usually employees or early investors looking to cash out some of their equity—with accredited investors eager to buy in.

These platforms have really changed the game, bringing a welcome dose of structure and transparency to what used to be a notoriously murky process. They typically offer:

- A curated list of available companies: You get a menu of opportunities across various high-growth sectors.

- Standardised deal structures: This helps simplify the legal and paperwork side of things, which can be daunting.

- A baseline of due diligence: While you absolutely must do your own homework, the platform usually does some initial vetting of the companies and sellers.

The Power of Syndicates and Angel Groups

Another fantastic way to get involved is by joining an investment syndicate or an angel investor group. A syndicate is usually led by an experienced investor who finds a deal and then invites others to pool their money to make the investment happen. This model has some real perks.

First, you get to piggyback on the deal-sourcing skill and due diligence of the syndicate lead. Second, by pooling funds, you can get a seat at a table that might otherwise require a massive minimum investment—far more than you might want to commit on your own. Angel groups work in a similar way, acting as networks where individuals team up to find and fund companies, and many now participate in these later, pre-IPO rounds too.

Tapping into Pre-IPO Funds

If you're looking for a more "hands-off" way to get exposure, investing in a pre-IPO fund is a brilliant option. These are specialised funds that build a diversified portfolio of shares in multiple late-stage private companies. Instead of putting all your eggs in one basket, you’re spreading your risk across a whole range of promising ventures chosen by professional fund managers.

This route is perfect for investors who don't have the time or deep expertise to source and vet individual deals themselves. The fund does all the heavy lifting, from finding the deals to closing them. The trade-off, of course, is that you'll pay management fees and have less say over the specific companies you're invested in, but the instant diversification is a huge plus.

The timing for these opportunities in India couldn't be better. The Indian IPO market is on a steep upward trajectory, which naturally makes getting in at the pre-IPO stage even more attractive. Projections suggest that total equity fundraising through IPOs in India could hit 19.6 billion in 2024. This growth, which could make India's IPO market second only to the US, is being driven by upcoming billion-dollar listings from names like Groww, Pine Labs, and Lenskart. You can dive deeper into this trend and what it means for investors in PYMNTS.com's analysis of the 2025 IPO outlook.

Vetting a Private Company Like a VC

undefined

So, you've found a promising deal. This is the moment where the real work begins—the part that separates seasoned pre-IPO investors from the hopeful speculators. Vetting a private company is a world away from analysing a listed one. You're working with much less public information, which means you have to roll up your sleeves and dig deep to build a complete picture.

The aim isn't just to spot a "good" company. It's to figure out if it’s a good investment at its current valuation. It's time to put on your venture capitalist (VC) hat and start asking the tough questions.

Analysing the Business Fundamentals

Before you even glance at a spreadsheet, you need to understand the heart of the business. What problem are they actually solving? Is their solution truly compelling, or just a nice-to-have? A flashy pitch deck is one thing; a sustainable business model is what generates real, long-term value.

Start by zooming out and looking at their position in the market. Are they a leader in a growing industry, or just another small fish in a crowded, stagnant pond? I always look for a strong competitive moat—that could be proprietary tech, a powerful brand people trust, or a network effect that makes it harder for others to catch up. That’s what gives a company staying power.

Then, zero in on the product or service itself. Is it something customers genuinely love and can't imagine living without? Look for evidence of strong product-market fit, like low customer churn, plenty of organic word-of-mouth growth, and glowing user reviews. To make smart calls, you absolutely need to be gaining venture clarity on what makes the company tick.

Diving into the Financials and Valuation

Once you have a solid feel for the business, it's time to crunch the numbers. Financials from private companies aren't as standardised as their public counterparts, so you need to know exactly what to look for. The trick is to assess both where the company is now and its potential for future growth.

Here are the metrics I always scrutinise:

- Revenue Growth: Is it growing consistently year-over-year? Be cautious if you see lumpy or slowing growth, as that can be a symptom of deeper issues.

- Profitability and Margins: Most late-stage startups aren’t profitable yet, and that’s often fine. The more important question is whether their unit economics make sense. Is there a clear, believable path to profitability down the line?

- Cash Burn Rate: This is simply how fast the company is spending its cash. A high burn rate isn't an immediate deal-breaker if it's fuelling rapid, efficient growth. You just need to be sure they have enough cash runway to hit their next major milestone or, ideally, an IPO.

The Essential Due Diligence Checklist

To get the full, unvarnished picture, you need to get your hands on a few key documents. These provide an inside look at the company’s operational and financial skeleton. If a seller or platform is hesitant to provide these, that’s a major red flag.

Key Documents to Review

| Document | What It Tells You | Why It Matters |

| Financial Statements | A detailed look at revenue, expenses, assets, and liabilities from the last 2-3 years. | This is the bedrock of your financial analysis. It reveals growth trends and the company's overall health. |

| Capitalisation Table | A breakdown of who owns what percentage of the company—founders, investors, and employees. | A messy or overly diluted cap table can signal future headaches and dilute your potential returns. |

| Latest Investor Deck | The company's own narrative, strategy, and market analysis from its most recent funding round. | This gives you a direct line into how management sees the business and its path forward. |