Riding the AI SaaS Wave: Where Smart Money is Flowing

Want to know which AI SaaS trends are attracting major global investment? This listicle reveals seven key areas where smart money is flowing, providing valuable insights for investors like you. Understanding these trends is crucial for identifying promising growth opportunities in the evolving SaaS market, particularly for those interested in AI SaaS, NSE shares, and unlisted shares like Apollo Green, Polymatech, VCI Chemicals, and Urban Tots. Discover where global investors are betting on AI SaaS trends and potentially position yourself for future gains.

1. Generative AI for Enterprise Applications

Generative AI is rapidly transforming the enterprise SaaS landscape, offering unprecedented opportunities for businesses to automate tasks, enhance creativity, and boost productivity. This technology leverages sophisticated algorithms trained on vast datasets to generate novel content, ranging from text and images to code and even music. By automating previously manual processes, generative AI empowers businesses to streamline workflows, accelerate innovation, and unlock new levels of efficiency. This makes it a key trend that global investors are betting on, particularly within the SaaS sector.

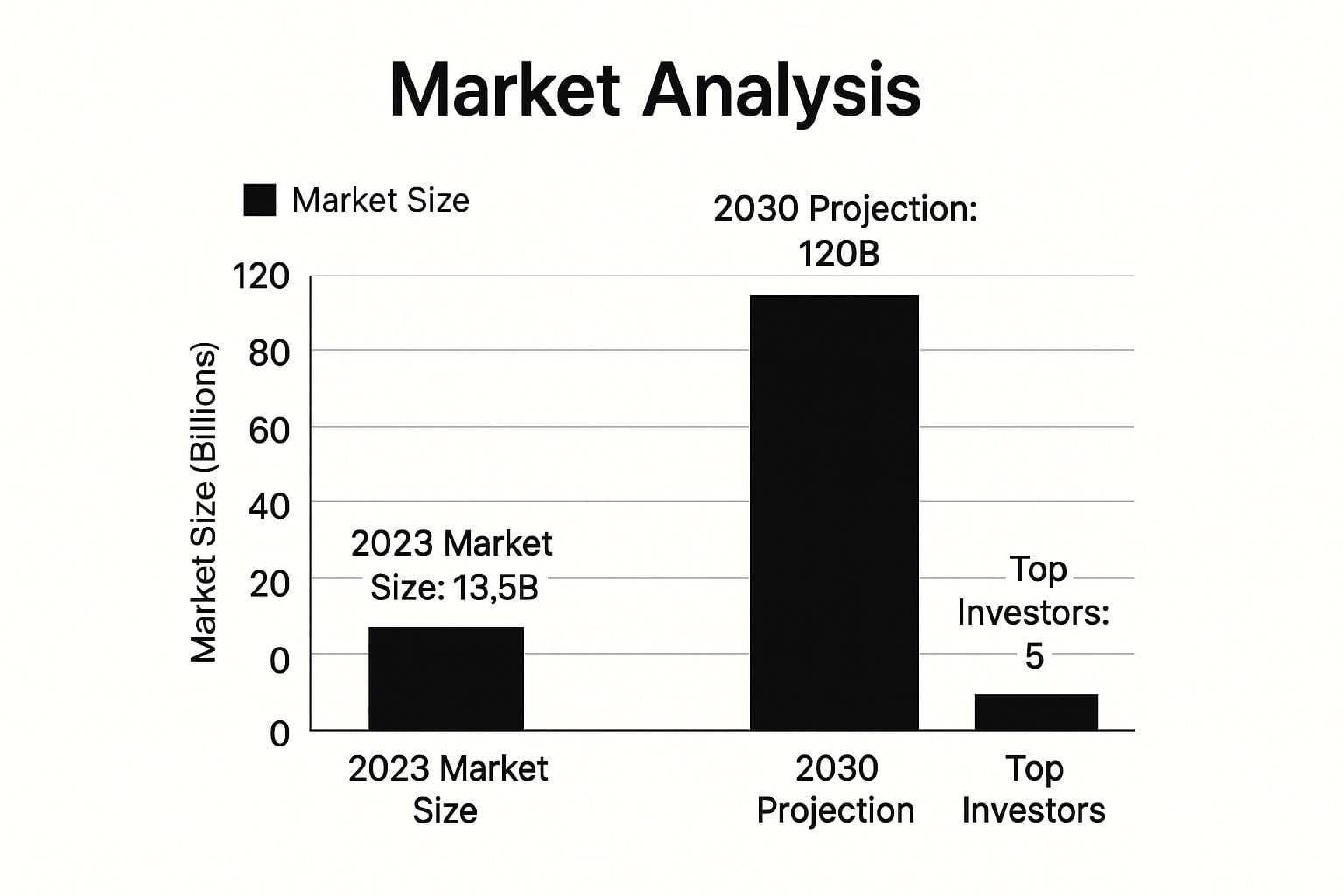

The infographic above visualizes the projected growth of the generative AI market in enterprise applications, segmented by key functionalities like content creation, code generation, and design. It uses a bar chart format to depict the market size in billions of USD across different years. For instance, the chart highlights that the market for AI-powered content creation is expected to grow significantly faster than other segments, illustrating the immense potential investors see in this area. As seen in the infographic, text generation for marketing, code generation for developers, and image synthesis for design are all experiencing a surge in demand, driven by the need for automation and scalability.

This surge in demand is reflected in the increasing number of successful implementations across various industries. OpenAI's GPT models, for instance, are now integrated into Microsoft's product suite, powering features like automated email composition and content generation within applications like Word and PowerPoint. Jasper AI, a platform specializing in AI-driven marketing copy, has raised over $125 million in funding, highlighting investor confidence in this specific application of generative AI. Similarly, GitHub Copilot utilizes generative AI to assist developers by suggesting code completions and generating entire functions, significantly speeding up the development process. Copy.ai and similar tools are helping marketing teams scale content production by automating the creation of blog posts, social media updates, and advertising copy. In the design world, integrations with platforms like Midjourney and DALL-E are revolutionizing commercial design applications, enabling rapid prototyping and ideation.

Generative AI offers several key features beneficial to enterprises: text, image, and code generation capabilities; personalized content creation at scale; seamless integration with existing workflows; continuous learning and improvement; and the ability to fine-tune models for specific business needs. These features translate into significant advantages, including dramatically increased productivity for creative and technical teams, rapid prototyping and ideation capabilities, efficient scaling of content creation, reduced time-to-market for products and campaigns, and the ability to operate 24/7 without human fatigue.

However, it's crucial to acknowledge the potential downsides. Generative AI can sometimes produce inaccurate or biased content, requiring human oversight and editing. The computational costs and energy consumption can be high. Intellectual property and copyright concerns surrounding generated content need careful consideration. Finally, the automation capabilities of generative AI may lead to displacement of certain types of creative jobs.

For businesses in India looking to capitalize on this transformative technology, it's important to start with specific, narrow use cases. Implement human review processes for AI-generated content, train models on company-specific data when possible, set clear guidelines on acceptable use within the organization, and track ROI metrics specific to time saved and output quality. This will help Indian investors, whether experienced or first-time, as well as institutional investors and wealth management professionals, make informed decisions about investing in this AI SaaS trend. This is especially relevant for those interested in NSE shares, unlisted shares, or specific companies like Apollo Green Shares, Polymatech Shares, VCI Chemicals, and Urban Tots.

Learn more about Generative AI for Enterprise Applications

This trend deserves its place on the list of "AI SaaS trends global investors are betting on" due to its transformative potential across various industries. The increasing investment in companies like OpenAI (backed by Microsoft), Anthropic (backed by Google and Amazon), Stability AI, and Cohere (backed by Tiger Global and Index Ventures), alongside the backing of major investors like Sequoia Capital and Andreessen Horowitz, underscores the significant interest and potential for high returns in this rapidly evolving space. This makes generative AI a compelling opportunity for investors in the IN region, especially as the global market expands.

2. Vertical-Specific AI SaaS Solutions

One of the most compelling AI SaaS trends global investors are betting on is the rise of vertical-specific solutions. Instead of trying to be everything to everyone, these AI platforms cater to the unique needs of particular industries, offering specialized functionality and a more targeted approach. This specialization translates into higher accuracy, faster implementation, and better ROI for businesses operating within those specific sectors. This trend is driven by the realization that a one-size-fits-all approach to AI often falls short when addressing the complexities and nuances of individual industries.

These platforms leverage industry-specific data models and algorithms, pre-built workflows tailored to sector-specific processes, and built-in compliance with industry regulations. They also incorporate domain-specific language understanding and seamless integration with industry-standard tools and systems. For example, a vertical AI solution for healthcare might be trained on medical images and terminology, while one for finance could be designed to analyze financial statements and market data. This tailored approach leads to more accurate insights and predictions compared to general-purpose AI. Learn more about Vertical-Specific AI SaaS Solutions

Several successful examples demonstrate the power of this approach. Viz.ai uses AI for stroke detection in healthcare and has secured over 115 million Series D round. Harvey is revolutionizing legal work with its AI assistant, having garnered $21 million in funding. Other notable examples include Fero Labs, applying machine learning to manufacturing optimization, and Ocrolus, using AI for document processing in financial services. These successes highlight the growing interest and investment in vertical AI solutions across diverse sectors.

Pros:

- Higher accuracy and relevance: Tailored algorithms and data models lead to more precise insights.

- Faster time to value: Pre-built workflows and integrations accelerate implementation and impact.

- Better handling of specialized terminology and contexts: Domain-specific language understanding enhances accuracy and efficiency.

- Easier regulatory compliance: Built-in compliance features streamline adherence to industry standards.

- More targeted ROI for specific business processes: Optimized solutions directly address key industry challenges.

- Limited market size compared to horizontal solutions: Focusing on a specific niche reduces the potential customer base.

- Requires deep domain expertise to develop effectively: Building specialized solutions demands in-depth industry knowledge.

- May face resistance from traditional industry players: Established companies may be hesitant to adopt new technologies.

- Higher development costs for specialized features: Tailored functionality requires significant investment in development.

- Potential for market saturation in popular verticals: Increased competition can limit growth opportunities.

- Partner with industry experts: Collaborate with experienced professionals to ensure domain expertise.

- Focus on solving high-value problems specific to the industry: Target critical challenges that offer significant ROI potential.

- Build compliance and security features from the ground up: Prioritize security and regulatory compliance from the outset.

- Develop ROI calculators specific to industry metrics: Demonstrate the value proposition using relevant industry benchmarks.

- Create implementation playbooks for industry-specific processes: Facilitate smooth and efficient adoption within target organizations.

3. AI-Powered Analytics and Business Intelligence

AI-powered analytics and business intelligence (BI) is one of the hottest AI SaaS trends global investors are betting on, and for good reason. This technology represents a significant leap beyond traditional BI tools. Instead of simply reporting on past performance, these platforms leverage machine learning to provide predictive insights, detect anomalies, and automate complex data analysis. This democratizes access to sophisticated analytics, empowering decision-makers at all levels – from experienced investors to individual NSE shareholders interested in companies like Apollo Green, Polymatech, VCI Chemicals, or Urban Tots – with data-driven insights.

How it Works:

These platforms ingest data from various sources and utilize machine learning algorithms to identify patterns, forecast future trends, and generate actionable recommendations. Users can interact with the platform using natural language queries, eliminating the need for complex coding or data science expertise. The AI handles the heavy lifting, surfacing hidden insights and presenting them in easy-to-understand visualizations and narratives.

Features and Benefits:

- Natural Language Querying: Ask questions about your business data in plain English.

- Automated Anomaly Detection: Identify unusual patterns and potential problems proactively.

- Root Cause Analysis: Quickly pinpoint the underlying reasons for anomalies.

- Predictive Forecasting & Scenario Modeling: Anticipate future market trends and evaluate different business strategies.

- Auto-Generated Visualizations & Narratives: Understand complex data at a glance.

- Prescriptive Recommendations: Receive AI-driven suggestions tailored to your specific business context.

- Accessibility: Empowers non-technical users to perform advanced analytics.

- Efficiency: Drastically reduces time spent on manual data analysis.

- Deeper Insights: Uncovers hidden patterns and correlations that humans might miss.

- Proactive Decision-Making: Enables data-driven decisions based on predictive insights.

- Scalability: Extends advanced analytics capabilities across the organization.

- Black Box Effect: Potential lack of transparency in how AI arrives at its conclusions.

- Data Dependency: Requires clean, well-structured data for optimal performance.

- Overreliance: Risk of over-dependence on automated insights without critical evaluation.

- Privacy Concerns: Careful handling of sensitive business data is crucial.

- Validation Challenges: Difficulty in independently verifying the accuracy of AI-generated recommendations.

- ThoughtSpot: An AI-driven analytics platform with substantial funding ($645M) focused on search-driven analytics.

- DataRobot: Provides automated machine learning solutions for enterprises.

- Sisu Data: Offers diagnostic analytics to understand changes in business metrics.

- Pecan AI: Focuses on making predictive analytics accessible without requiring data scientists.

- Tableau (with Einstein Analytics): Integrates Salesforce's AI capabilities for enhanced data visualization and analysis.

- Data Quality: Start with clean, well-structured datasets.

- Human Oversight: Implement review processes for AI-generated insights.

- Training: Educate users on how to effectively query using natural language.

- Domain Expertise: Combine AI insights with human experience and intuition for the best results.

- Feedback Loops: Continuously refine models and improve prediction accuracy over time.

For investors, including those in the IN region interested in unlisted shares or NSE-listed companies, AI-powered analytics provides a critical edge. Whether evaluating potential investments in high-growth sectors or managing existing portfolios, these platforms offer powerful tools to:

- Identify Emerging Trends: Spot investment opportunities before they become mainstream.

- Assess Risk and Opportunity: Make more informed decisions based on data-driven insights.

- Optimize Portfolio Performance: Identify areas for improvement and maximize returns.

- Gain Competitive Advantage: Access to advanced analytics can be a significant differentiator in the market.

The growth of this sector is fueled by major players like Snowflake, Google (Looker), Microsoft (Power BI), Salesforce (Tableau/Einstein Analytics), and investments from firms like Sequoia Capital. This signals strong confidence in the future of AI-powered analytics.

This trend deserves a spot on this list due to its transformative potential. By democratizing access to advanced analytics, it empowers businesses and investors of all sizes to make smarter, data-driven decisions, leading to better outcomes and greater success.

4. Autonomous AI Agents for Business Processes

Autonomous AI agents are rapidly emerging as a key trend in the AI SaaS landscape, attracting significant attention from global investors who are betting on their potential to revolutionize business processes. These sophisticated AI systems are designed to execute complex tasks with minimal human intervention, representing a significant leap forward in automation. They combine multiple AI capabilities like natural language processing, planning, and execution monitoring to handle end-to-end processes such as customer support, sales outreach, scheduling, data entry, and even basic decision-making. This makes them a compelling investment opportunity, particularly for those interested in AI SaaS trends.

These agents operate by breaking down complex tasks into smaller, manageable steps, executing them sequentially, and adapting their approach based on real-time feedback. Features like memory of past interactions, self-correction mechanisms, and API integrations with existing business systems empower them to operate autonomously and seamlessly integrate into existing workflows. This approach offers a range of advantages, including dramatically reduced operational costs for routine tasks, 24/7 availability, and scalability to handle fluctuating workloads. By automating repetitive tasks, autonomous agents free up human employees to focus on higher-value activities, driving greater efficiency and productivity. For Indian investors and others interested in NSE shares and emerging technologies, autonomous AI agents represent a compelling investment theme within the SaaS sector.

Examples of successful implementations include:

- Adept AI's Action Transformer models: This company has raised $415M in funding to develop AI agents capable of interacting with software and performing complex digital tasks.

- Anthropic's Claude assistant: This powerful AI assistant is being utilized for a variety of complex workflows, demonstrating the versatility of this technology.

- HyperWrite's AI agents for content workflows: These agents streamline content creation processes, offering a practical application of autonomous AI.

- Forethought AI's customer service automation platform: This platform utilizes AI agents to enhance customer service efficiency and responsiveness.

- Moveworks' IT support automation: Valued at over $1B, Moveworks showcases the significant market potential of autonomous AI agents in IT support.

- Dramatically reduces operational costs for routine tasks.

- Operates 24/7 with consistent performance.

- Scales easily to handle volume fluctuations.

- Frees human workers for higher-value activities.

- Creates detailed audit trails of all actions taken.

- Limited ability to handle truly novel situations.

- Potential for cascading errors without proper monitoring.

- May require significant customization for complex processes.

- Employee concerns about job displacement.

- Customer perception issues when interacting with AI agents.

- Start with narrow, well-defined processes before expanding to more complex tasks.

- Implement robust monitoring and human oversight systems to mitigate potential errors.

- Create clear escalation paths for complex situations that require human intervention.

- Carefully design the handoff between AI and human agents to ensure a seamless experience.

- Continuously train agents on new scenarios and edge cases to improve performance and adaptability.

The rise of autonomous AI agents is being fueled by significant investments and research. Key figures like Sam Altman's investments in agent companies, Sequoia Capital's dedicated thesis on autonomous AI agents, and former Google DeepMind researchers founding agent startups signal strong confidence in the future of this technology. Softbank Vision Fund's investments in process automation and Microsoft's Copilot vision further solidify this trend as a significant force in the tech industry. This confluence of factors makes autonomous AI agents a promising investment area for both experienced and first-time investors, including those in India interested in unlisted shares and emerging technologies. The potential for these agents to transform business operations and unlock new levels of efficiency justifies their position as a key AI SaaS trend to watch.

5. AI-Driven Personalization and Recommendation Engines

AI-driven personalization and recommendation engines are one of the hottest AI SaaS trends global investors are betting on, and for good reason. These sophisticated systems leverage the power of artificial intelligence, particularly deep learning, to deliver hyper-personalized experiences across various customer touchpoints. This goes far beyond basic segmentation, crafting individual experiences at scale by analyzing user preferences, predicting future needs, and serving up highly relevant content or product recommendations. This, in turn, drives engagement, conversions, and ultimately, revenue. For investors, particularly those in the IN region looking for promising NSE shares or exploring unlisted opportunities, this trend represents a significant growth area.

How it Works:

These engines ingest vast amounts of user data, including browsing history, purchase patterns, and even real-time interactions, to build a comprehensive understanding of individual preferences. Multi-dimensional recommendation algorithms then process this data, identifying patterns and predicting what each user is most likely to engage with next. This might involve suggesting products on an e-commerce site, curating personalized playlists on a music streaming platform, or surfacing relevant articles on a news website.

Features that Fuel Personalization:

- Real-time Personalization: Adapts to user behavior as it happens, ensuring recommendations are always current and relevant.

- Multi-Dimensional Recommendation Algorithms: Go beyond basic collaborative filtering to incorporate diverse data points for more accurate predictions.

- Cross-Channel Personalization: Provides a consistent personalized experience across websites, mobile apps, email, and other channels.

- Progressive Profiling and Preference Learning: Continuously refines user profiles as new data becomes available, leading to increasingly accurate recommendations.

- A/B Testing and Optimization Frameworks: Built-in tools allow for constant refinement and improvement of personalization strategies.

- Increased Conversion Rates and Customer Engagement: Highly relevant recommendations translate directly into higher sales and more active users.

- Reduced Customer Acquisition Costs: Better targeting allows businesses to reach the right audience more efficiently.

- Improved Customer Retention and Lifetime Value: Personalized experiences foster loyalty and encourage repeat business.

- More Relevant User Experiences at Scale: Delivering individual experiences to millions of users simultaneously becomes feasible.

- Efficient Discovery of Relevant Content or Products: Users can easily find what they're looking for, leading to greater satisfaction.

- Privacy Concerns: Collecting and utilizing user data raises legitimate privacy concerns that must be addressed transparently.

- Filter Bubbles and Echo Chambers: Over-personalization can limit exposure to diverse perspectives and reinforce existing biases.

- Bias Reinforcement: Historical data may contain biases that can be perpetuated by AI algorithms.

- Data Dependency: These systems require significant amounts of data to function effectively.

- Explainability Challenges: Understanding how complex AI algorithms arrive at specific recommendations can be difficult.

- Dynamic Yield (acquired by McDonald's and later Mastercard): Provides personalized experiences for fast-food and financial services customers.

- Algolia: Offers AI-powered search and recommendation capabilities for various industries.

- Coveo: Focuses on commerce personalization, helping businesses optimize product discovery.

- Constructor.io: Powers AI-driven product discovery for e-commerce sites.

- Bloomreach: Offers a comprehensive personalized commerce experience platform.

- Balance Personalization with Privacy: Be transparent about data collection practices and offer users control over their data.

- Start Small: Focus on high-impact areas like product recommendations or content personalization.

- Gather Diverse Data: Implement both explicit (e.g., user ratings) and implicit (e.g., browsing history) preference collection methods.

- Continuous Improvement: Build feedback loops to constantly refine recommendation algorithms.

- Cold-Start Strategies: Develop strategies for new users with limited data, such as leveraging popular items or demographic information.

The success stories like Netflix's recommendation engine (estimated to contribute over $1 billion in annual value), Spotify's Discover Weekly, Amazon's product recommendations (driving 35% of sales), and Pinterest's personalized discovery algorithms highlight the immense potential of AI-driven personalization. Major investors, including Insight Partners and NEA, are actively investing in this space, signifying its importance. For Indian investors exploring NSE shares or unlisted opportunities like Apollo Green Shares, Polymatech Shares, VCI Chemicals, or Urban Tots, understanding this trend is crucial for identifying promising investment opportunities in the rapidly evolving AI SaaS landscape. This trend isn’t just a fleeting fad; it’s a fundamental shift in how businesses interact with customers, making it a compelling area for investors of all types, from experienced investors to first-time investors and wealth management professionals, especially in the IN region.

6. AI Cybersecurity and Fraud Prevention

Among the AI SaaS trends global investors are betting on, AI-powered cybersecurity and fraud prevention solutions stand out as a critical area of growth. These platforms leverage machine learning to analyze vast datasets, identifying patterns, behaviors, and anomalies that indicate potential security threats or fraudulent activities in real-time. This capability allows them to adapt to evolving threats much faster than traditional, rule-based systems, making them highly attractive to investors. They offer a crucial defense in an increasingly complex digital landscape, protecting businesses and individuals from sophisticated cyberattacks and financial fraud.

These AI-driven solutions utilize several key features: behavioral analysis and anomaly detection to pinpoint unusual activity; predictive threat intelligence to anticipate and mitigate emerging risks; automated incident response capabilities to contain breaches quickly; user and entity behavior analytics (UEBA) to understand and track user actions; and continuous learning from new attack patterns to stay ahead of evolving threats. This continuous adaptation is crucial in the current cybersecurity environment, where threats are constantly evolving and becoming more sophisticated.

This approach offers several significant advantages. AI can detect novel threats that traditional systems would miss, reducing the risk of zero-day exploits and other advanced attacks. Compared to rule-based systems, AI reduces false positives, freeing up security teams to focus on genuine threats. Real-time response capabilities minimize dwell time, limiting the damage an attacker can inflict. Automated adaptation to evolving attack techniques ensures ongoing protection. Lastly, it significantly reduces the manual workload for IT security teams, allowing them to focus on strategic security initiatives.

However, there are also challenges. AI systems themselves are susceptible to adversarial attacks, where malicious actors try to manipulate the AI's algorithms. Real-time analysis can require significant computational resources, potentially increasing operational costs. Ongoing training with current threat data is necessary to maintain effectiveness. Monitoring user behavior raises privacy concerns. Finally, explaining how an AI arrived at a specific threat detection can be challenging, making incident investigation and response more complex.

Several companies exemplify the successful implementation of AI in cybersecurity. Darktrace's Enterprise Immune System, valued at 284M in funding. Vectra AI provides a threat detection and response platform. Feedzai leverages AI for fraud prevention within financial services. These examples highlight the breadth of applications for AI in cybersecurity, attracting significant investment across different areas of the sector. Learn more about AI Cybersecurity and Fraud Prevention While seemingly unrelated, understanding the digital transformation in other sectors, like healthcare with Pharmeasy, helps illustrate the growing need for robust cybersecurity measures.

For investors and businesses considering implementing AI cybersecurity solutions, several tips are crucial: Combine AI detection with human security expertise for optimal results. Establish a baseline of normal behavior before deploying the AI to ensure accurate anomaly detection. Implement a gradual rollout, starting with monitoring mode to observe and fine-tune the system. Create clear processes for handling AI-flagged incidents. Regularly retrain models with the latest threat intelligence to maintain effectiveness against emerging threats.

AI cybersecurity and fraud prevention deserves its place amongst the top AI SaaS trends because it addresses a critical and growing need in the digital world. For Indian investors, in particular, with the increasing digitization of the economy and rising cyber threats, this sector presents a compelling investment opportunity. Whether you are an experienced investor, a first-time investor, or part of an institutional investment firm, the potential for growth in AI-driven cybersecurity is undeniable. This trend also aligns with the increasing interest in NSE shares, Apollo Green Shares, Polymatech Shares, VCI Chemicals, and Urban Tots, reflecting the broader shift towards technology-driven solutions in various sectors.

7. AI for Developer Productivity and DevOps

AI for Developer Productivity and DevOps is one of the hottest AI SaaS trends global investors are betting on, and for good reason. This category encompasses AI-powered tools designed to streamline and enhance every stage of the software development lifecycle, from coding and testing to deployment and maintenance. By automating tedious tasks, identifying potential issues early, and fostering better collaboration between development and operations teams, these solutions promise significantly faster development cycles, reduced errors, and more efficient software delivery. This trend is particularly relevant for Indian investors interested in NSE shares and unlisted shares, as many promising startups in this space are emerging domestically.

These tools work by leveraging various AI techniques, including machine learning and natural language processing, to analyze code, predict potential problems, and even generate code snippets. They integrate directly into existing development workflows, acting as intelligent assistants for developers.

Features and Benefits:

- AI pair programming and code completion: Tools like GitHub Copilot and Tabnine predict and suggest code completions as developers type, significantly speeding up the coding process.

- Automated code review and quality analysis: Platforms like DeepCode (acquired by Snyk) and Amazon CodeGuru automatically scan code for bugs, security vulnerabilities, and style inconsistencies, ensuring higher code quality.

- Intelligent test generation and optimization: Solutions like Ponicode utilize AI to automatically generate test cases, optimizing test coverage and reducing the time spent on manual testing.

- Predictive DevOps for deployment optimization: Harness.io, for instance, uses AI to predict and prevent deployment failures, ensuring smoother and more reliable releases.

- Natural language to code translation: Emerging tools are exploring the possibility of translating natural language descriptions into functional code, further simplifying the development process.

- Significantly increased developer productivity (40-60% in some cases): By automating repetitive tasks and providing intelligent assistance, these tools free up developers to focus on more complex and creative work.

- Reduced bugs and security vulnerabilities in production: Early detection of potential issues through AI-powered analysis leads to more robust and secure software.

- Accelerated onboarding for new developers: AI assistants can guide new team members through the codebase and best practices, shortening the learning curve.

- Enabled consistent code quality across teams: Automated code review and analysis ensure adherence to coding standards across the entire development team.

- Optimized CI/CD pipelines and deployment processes: AI-powered DevOps tools streamline deployment workflows and minimize downtime.

- Potential over-reliance on generated code: Developers must avoid blindly accepting AI-generated code without proper review and understanding.

- Security concerns around code suggestions: AI models trained on public code repositories may inadvertently introduce security vulnerabilities if not carefully vetted.

- Learning curve for effective AI-assisted development: Developers need to adapt their workflows and learn how to effectively utilize these new tools.

- Licensing and attribution issues for generated code: The legal implications of using AI-generated code are still evolving and require careful consideration.

- Integration challenges with existing development workflows: Integrating these tools into existing development environments can sometimes be complex.

GitHub Copilot's integration with Microsoft's developer ecosystem showcases the potential of AI pair programming. Companies like Snyk, Harness.io, and Amazon are leveraging AI to revolutionize code review, DevOps, and testing, respectively. Learn more about AI for Developer Productivity and DevOps to understand how Indian companies are also participating in this trend.

Tips for Implementing AI for Developer Productivity and DevOps:

- Implement AI coding assistants gradually with proper training.

- Establish clear guidelines for reviewing AI-generated code.

- Focus on automating high-value, repetitive coding tasks first.

- Combine AI suggestions with human expertise and code review.

- Measure the impact of these tools on development velocity and quality metrics.

The growing demand for software and the increasing complexity of development processes make AI-powered developer tools a compelling investment opportunity. The potential for significant productivity gains, reduced development costs, and improved software quality has attracted significant investments from major players like Microsoft, Google, and Amazon, as well as leading venture capital firms like Andreessen Horowitz. The involvement of former GitHub and Stack Overflow executives in founding AI dev tools further validates the potential of this market. This trend offers exciting prospects for experienced investors, first-time investors, institutional investors, wealth management professionals, industry analysts and advisors, and especially Indian investors interested in NSE unlisted shares and companies like Razorpay, Apollo Green Shares, Polymatech Shares, VCI Chemicals, and Urban Tots. This burgeoning sector is ripe for disruption and presents a strong opportunity for substantial returns.

7 AI SaaS Trends Investment Comparison

| Trend | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

| Generative AI for Enterprise Applications | High - requires integration, fine-tuning, oversight | High - computational power, data, expertise | Increased productivity, rapid prototyping, scale | Content creation, marketing, customer support | Scales content creation; 24/7 operation; rapid ideation |

| Vertical-Specific AI SaaS Solutions | Medium-High - needs domain expertise and compliance | Medium-High - specialized data, domain experts | Higher accuracy, faster value realization | Industry-specific tasks in healthcare, finance | Better relevance, compliance, targeted ROI |

| AI-Powered Analytics and Business Intelligence | Medium - requires clean data, AI model integration | Medium - data infrastructure and training | Faster insights, predictive analytics | Data-driven decision making, forecasting | Democratizes analytics; reduces manual effort |

| Autonomous AI Agents for Business Processes | High - complex workflows, monitoring, customization | High - system integration and ongoing training | Reduced operational costs, 24/7 task automation | Routine tasks automation: support, scheduling | Frees human workers; scalable; detailed audits |

| AI-Driven Personalization & Recommendation Engines | Medium - requires user data and algorithm tuning | Medium - data collection, model training | Higher engagement, increased conversion | E-commerce, content platforms, marketing | Drives revenue growth; scalable personalization |

| AI Cybersecurity and Fraud Prevention | High - real-time, adaptive threat detection | High - continuous learning and compute power | Improved threat detection, reduced dwell time | IT security, fraud detection | Detects novel threats; reduces false positives |

| AI for Developer Productivity and DevOps | Medium - integration into workflows, training | Medium - trained AI models and infrastructure | Increased developer speed, reduced bugs | Software development, testing, deployment | Boosts productivity; reduces errors |